Global airline carriers could face up to $48 billion in losses this year, as the sector continues to struggle through a meaningful recovery from the Covid-19 pandemic.

The latest figures, which were published by the International Air Transport Association (IATA) on Wednesday, are about 25% worse than a previous forecast that called for a $38 billion deficit. The total losses for the global airline industry are expected to amount to around one-third of what the sector underwent in 2020, when losses climbed to $126.4 billion amid widespread government lockdowns and stay-at-home orders.

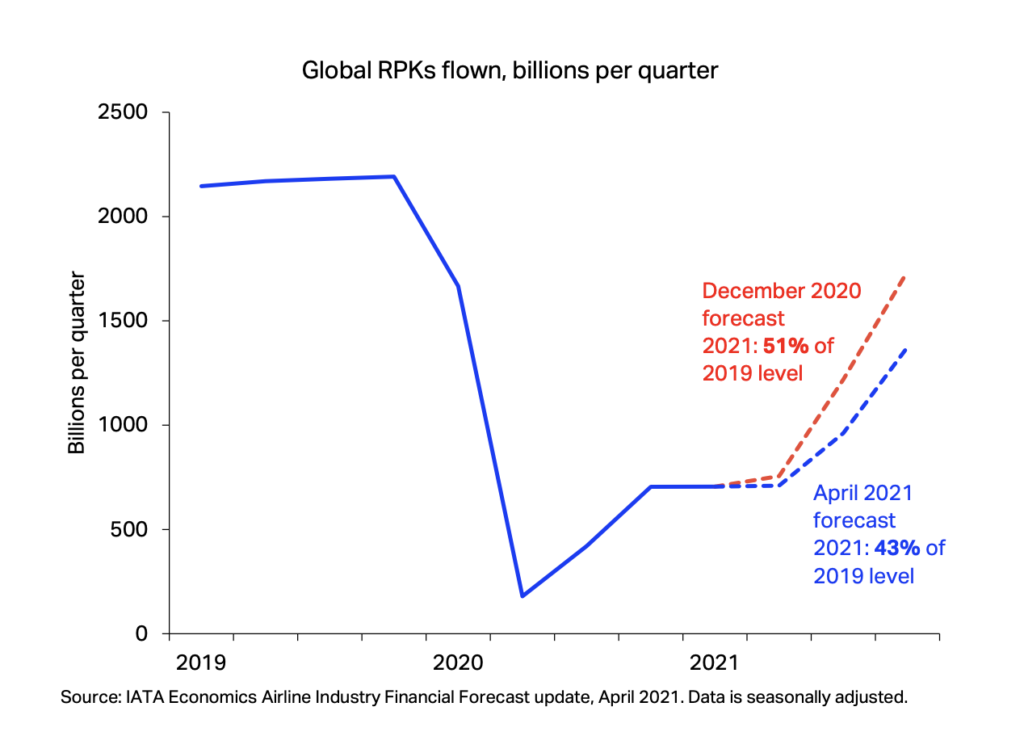

“This crisis is longer and deeper than anyone could have expected. Losses will be reduced from 2020, but the pain of the crisis increases,” said IATA Director General Willie Walsh in a statement. He noted that the air traffic restrictions previously imposed by major governments continue to affect international travel. In its latest forecast, the agency now expects global air traffic to reach 43% of pre-pandemic levels in 2021— albeit marking an improvement from last year, but still “far from a recovery.”

“Industry losses of this scale imply a cash burn of $81 billion in 2021 on top of $149 billion in 2020,” the IATA said, noting that government bailouts helped avoid widespread bankruptcies across the industry, which employs millions of people around the globe.

In the meantime, to make matters worse for the airline industry, the US State Department on Monday announced it will be broadening the “Do Not Travel” advisory to include up to 80% of countries around the world due to growing pandemic-related concerns. In response, the IATA warned that the lack of progress in reopening borders carries negative consequences for the wider global economy, as it puts the 88 million jobs related to the airline industry and subsequent $3.5 trillion in GDP at risk.

Information for this briefing was found via the IATA. Thee author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.