This past week, as many are aware, was the week of cannabis earnings season. The week saw many majors of the sector report earnings, including Canopy Growth Corp (TSX: WEED) (NYSE: CGC), Aurora Cannabis (TSX: ACB) (NYSE: ACB), Tilray (NASDAQ: TLRY), Cronos Group (TSX: CRON) (NASDAQ: CRON) and Sundial Growers (NASDAQ: SNDL) among many others. While The Deep Dive reported on many of these earnings individually, its easy to get lost in the weeds. As a result, we’ve compiled comparable data to get a better sense of where the sector as a whole is headed.

In addition to the major sector players that reported this week, we’ve included data from the smaller producers as well that made data just as readily available. Respectfully, we’ve left out Medipharm Labs, solely due to the fact that we were largely focused on the cultivators within the space and their comparable figures. The result is total of eleven licensed producers for which we’ve compiled data on to generate cross comparisons.

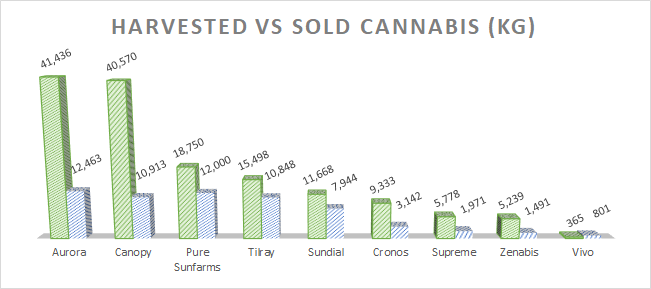

To start off, we began with analyzing total grams reported to have been produced during the three month period ended September 30, 2019. Notably, this will exclude outdoor harvest yields which saw cultivation begin within the month of October by the vast majority.

Amongst the 11 reporting issuers, only Aleafia Health and The Green Organic Dutchman left out hard cultivation figures, and unreliable data to be able to provide solid estimates. These two firms also elected to not inform the markets how much cannabis they actually sold during the period.

During the three month period, a total of 148,637 kilograms of cannabis is believed to have been harvested by ten producers. Whats in stark contrast to this figure however, is how much cannabis was actually sold, which was a drastically lower 61,573 kilograms of cannabis and cannabis equivalents. Aurora Cannabis was the largest producer and seller of cannabis by volume with 41,436 kg and 12,463 kg respectively.

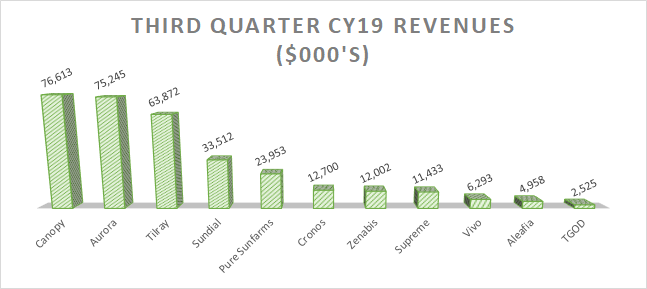

Despite having the highest volumes in sales, Aurora was not the winner in terms of highest revenues. That crown returned to Canopy Growth, even after taking into consideration returned product and write downs of $32.7 million during the quarter. Total reported revenues among cultivators this week totaled $323.1 million.

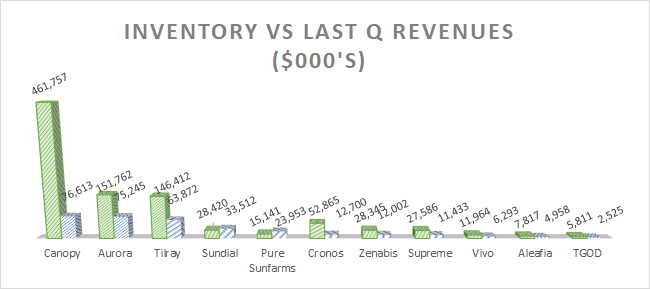

This is where things start to get interesting. After collecting the data, we scrolled through to see what comparisons we could make. One of the first things that jumped out at us was current inventory levels versus the reported revenues during the third quarter of calendar year 2019. Pure Sunfarms (which was reported via Village Farms) and Sundial Growers were the only two cultivators that reported revenue figures that were higher than current valuations of inventory levels.

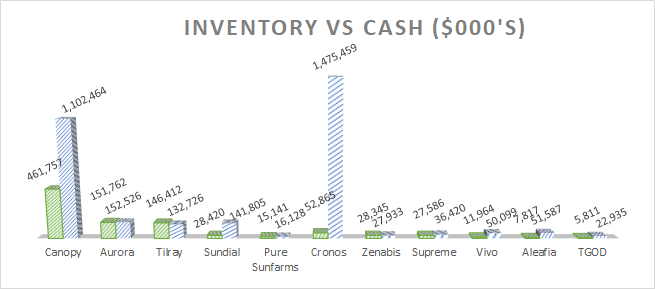

Inventory levels have begun to grow significantly among licensed producers, particularly among the larger cultivators with multiple facilities currently in production. On a comparison to current cash, several producers such as Tilray, Zenabis, and Aurora Cannabis, have crossed, or are about to cross, the point where inventory is currently larger than cash holdings. This trend can be worrisome, especially if producers are unable to liquidate product and thus are forced to write down the value of inventory.

Canopy Growth and Cronos Group notably skew this metric as a result of the significant cash infusions they have seen from major stakeholders stepping into the sector. Even still, Canopy has the largest inventory stockpile among all licensed producers that reported this week, with 49.2% of the total reported $937.8 million in inventory. Canopy Growth’s inventory figure is also notably above the aggregate $323.1 million in sales reported by Canadian cultivators this week.

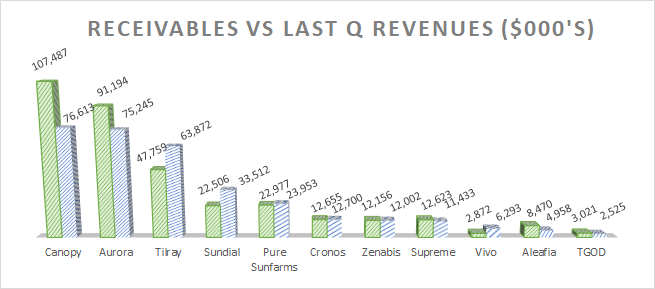

The last item we looked at with the compiled data, was receivables relative to last quarter revenues. An ongoing trend within the sector has been the continued build of accounts receivable among issuers. While a select few, such as Supreme Cannabis, notably had their receivables decrease during the quarter, the majority saw the figure rise. Numerous producers posted receivables higher than that of current quarter revenues, with many at or near break even on this metric. Canopy and Aurora were notably the two largest violators in this segment, while Tilray and Sundial were the two largest firms with a favorable balance in this category.

On an overall basis, earnings provided this week by numerous firms were extremely poor. Guidance was missed, sales declined, and every item under the sun was blamed for the results with provincial retail rollout, regulatory hurdles, and the prevalence of the illicit market being the most common complaints. This was coupled with seasonality, mechanical issues, and production errors that were further detrimental to quarterly results. Our Thursday coverage, Black Thursday in the Cannabis Sector, covered this rather briefly.

Here’s to hoping that the remaining results this month paint a brighter picture for the future of Canadian licensed cannabis producers.

Information for this analysis was found via Sedar. The author has no securities or affiliations related to the organizations explicitly mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.