The International Monetary Fund (IMF), alongside World Bank and G20, has made an unprecedented decision to cancel all debts owed by 111 countries effective May 1, 2020.

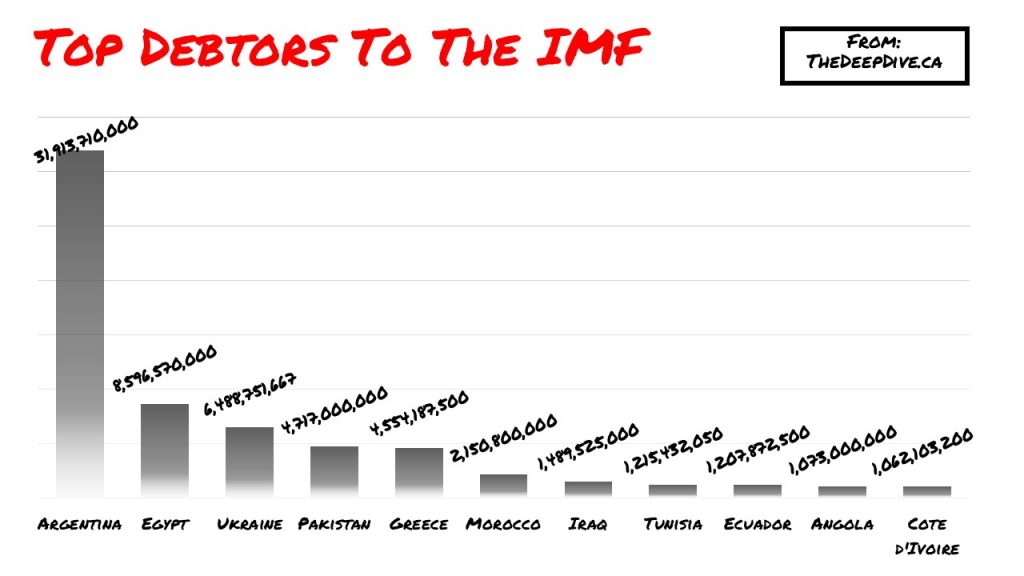

The day before the official commencement of the Spring Meetings, the IMF’s Executive Board has decided to cancel debt owed by countries that were already subject to significant debts before the onset of the coronavirus crisis. 76 of the countries receiving debt forgiveness fall under the International Development Association, and another 27 countries faced with various debt distress will also have their debt cancelled. The remainder of the 111 countries fall under either Low Income or Middle Income categories, and they too, will have their debts forgone.

The Board’s decision on debt cancellation is a part of a substantial move to help mitigate the spread of the deadly virus in developing countries, as well as further reduce stress and disruptions in the global supply chain of essential commodities. The cancellation of debt will ease burdens on public funds in developing countries so all efforts can go towards stopping the spread of COVID-19 without putting further unnecessary strain on financial systems.

Many of the countries that fall under the umbrella of debt cancellation were already faced with a mounting financial crisis. Many of the country’s economies are reliant on revenues generated from fossil fuels, and given the current downturn in commodity prices stemming from lockdowns around the globe, those countries are now left with collapsing economies. Therefore, the debt cancellation announcement will help the developing countries better allocate their already scarce resources and funds to alleviate some of the burdens from the coronavirus pandemic.

Information for this briefing was found via the International Monetary Fund and World Bank. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

This seems like a much bigger event than anyone is talking about.

BTFD

Gold… You want to own gold…