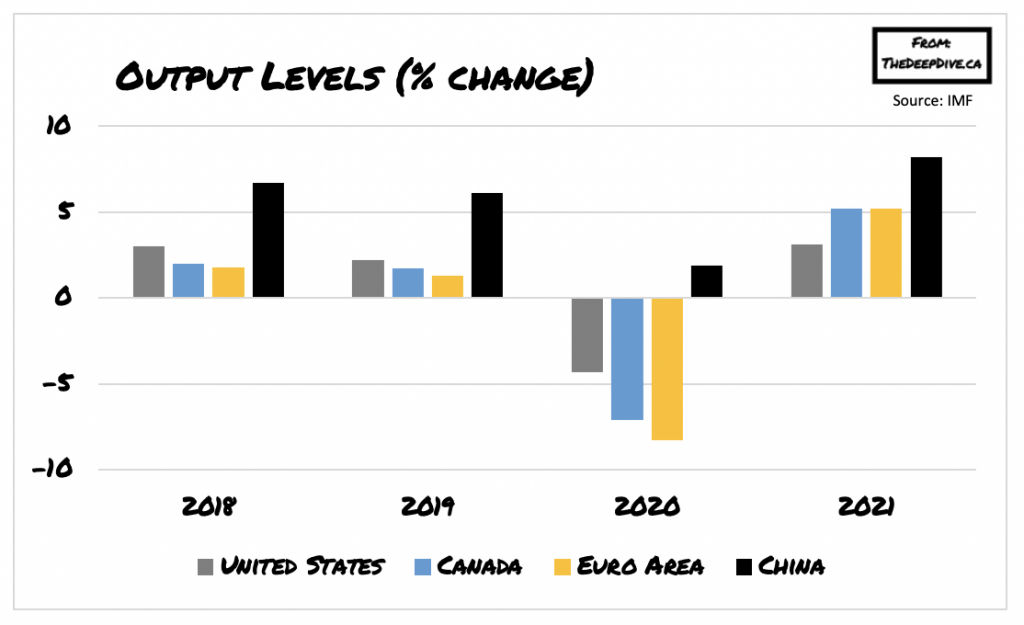

Although the global economy has shown signs of an optimistic recovery over the summer months, especially in the US and the euro area, pre-pandemic levels still remain far from reach.

According to a latest forecast released by the IMF, global GDP output is expected to contract by 4.4% in 2020, followed by a growth of 5.2% the following year. Back in June, the IMF predicted that the economy would recover by 5.4% come 2021, but the fund has since updated its outlook as a the number of worldwide COVID-19 cases continue to grow at an unprecedented rate.

This year’s global economic contraction is still slated to be the worst since the Great Depression, as the pandemic forced many countries around the world to impose lockdowns that ended up having significant consequences on the wellbeing of their economies. In addition, the rising death toll from the virus, which has now surpassed 1 million, has raised concern among governments, with many having re-imposed restrictions that were previously lifted during the summer.

The US economy is anticipated to decrease by 4.3% this year, which is better than the previous projected scenario of a 8% contraction. Then in the following year, growth is expected to amount to 3.1%, which is down from the IMF’s prior projection of 4.5%. In the meantime, the euro area is forecast to fall by a staggering 8.3% in 2020, before growing by 5.2% in 2021.

China on the other hand, is one of the only major economy that is projected to experience positive growth of 1.9% this year, after being heavily decimated at the beginning of the pandemic. Conversely, India will be the subject of the sharpest economic contraction, with a decline of 10.3% in 2020. Nonetheless, the IMF foresees it will not be until 2021 that global GDP levels will recover to pre-pandemic levels, with the majority of the output increase stemming from China. Many other countries, including the US, will not return to pre-pandemic output levels until at least 2022.

Moreover, the subdued global economic recovery in the medium run will be largely impacted by the rise in sovereign debt, which will rise to 125% of GDP levels for advanced economies in 2021, and to 65% of GDP levels for developing economies. However, the US will be dealt a significantly higher financial burden, with a $130 billion capital hole in the global banking system.

Information for this briefing was found via the IMF. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.