It looks as if the housing industry is slowly beginning to rebound from the financial ruin caused by the coronavirus pandemic. According to data compiled by the Mortgage Banker’s Association, there has been a decrease of the number of Americans making forbearance requests.

As of late, there are 4.1 million homeowners in some sort of forbearance program, and although the number of new mortgage deferral requests have been increasing, the new numbers coming in are at a decreasing rate. As of May 10, approximately 8.16% of total mortgages were in forbearance – which is only a 0.25% increase since May 3. This has been thus far the lowest increase since March.

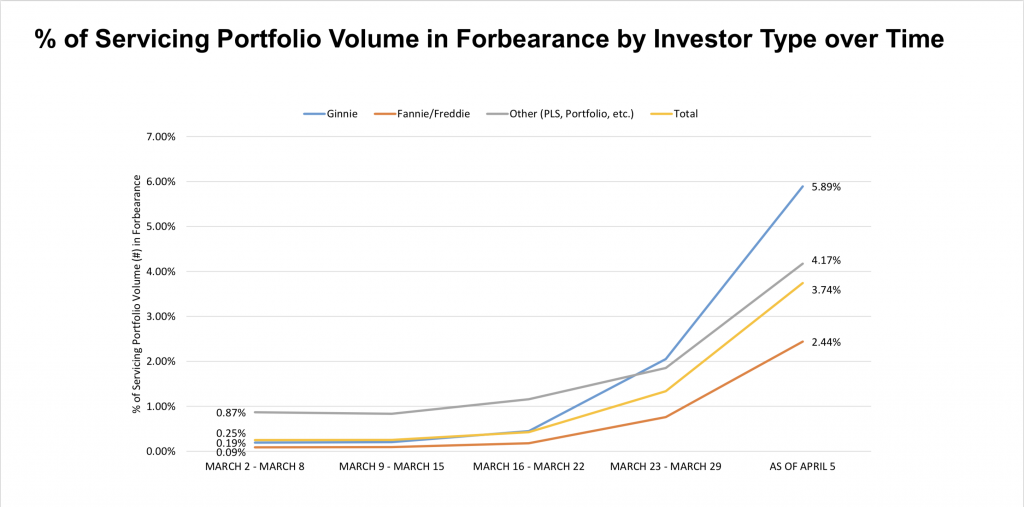

However, Ginnie Mae-backed mortgages are an exception to this emerging optimistic trend. Typically, loans issued through Ginnie Mae are for borrowers that either have poor credit or are first-time home buyers, and so far, these kind of borrowers are in the front lines of the pandemics financial ruin. As a result, Ginnie Mae has in excess of 11% of its mortgage loans in forbearance, indicating that the overall housing industry still has a long way to go before it is in a financially stable state.

Information for this briefing was found via Market Watch and the Mortgage Banker’s Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.