Both businesses and consumers across Canada are feeling the pressure of rising inflation and supply constraints, further substantiating the need for hawkish rate hikes from Bank of Canada policy makers.

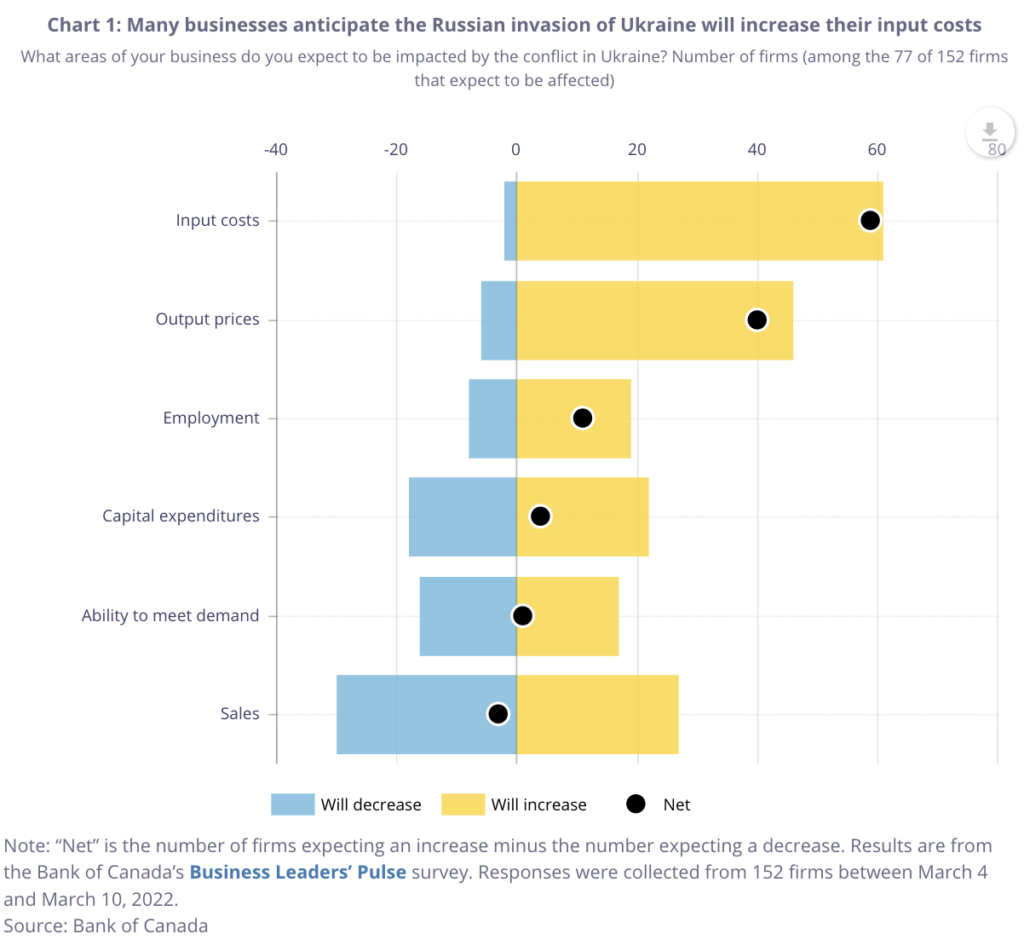

The central bank’s latest quarterly Business Outlook Survey showed Canada’s economy is facing added pressure from rapidly rising prices, supply chain disruptions, and a tightening labour market. To make matters worse, the war in Ukraine is expected to further increase input costs for businesses, as well as prolong delivery times and raise shipping prices.

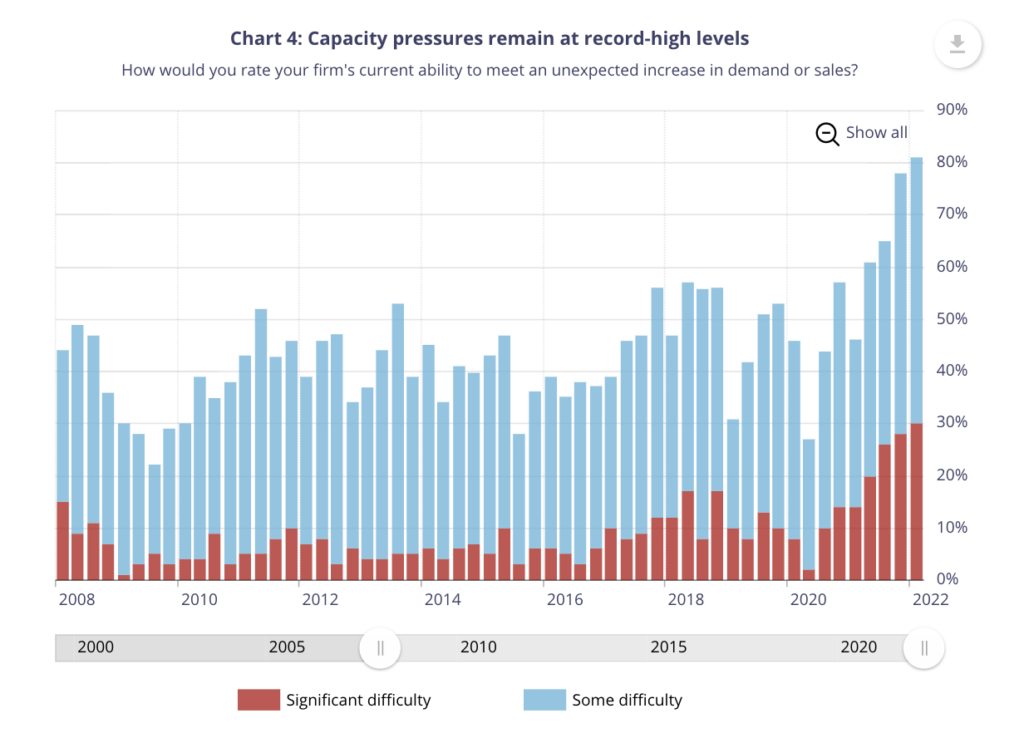

Canadian businesses anticipate robust sales growth in the next year, amid heightened domestic and foreign demand. However, four out of five firms— the highest proportion on the survey’s record— said they will face substantial difficulty in meeting a sudden increase in demand for goods and services. In fact, supply chain bottlenecks have worsened since the beginning of the year, and labour markets have only tightened compared to 12 months ago, further constraining businesses’ sales growth expectations.

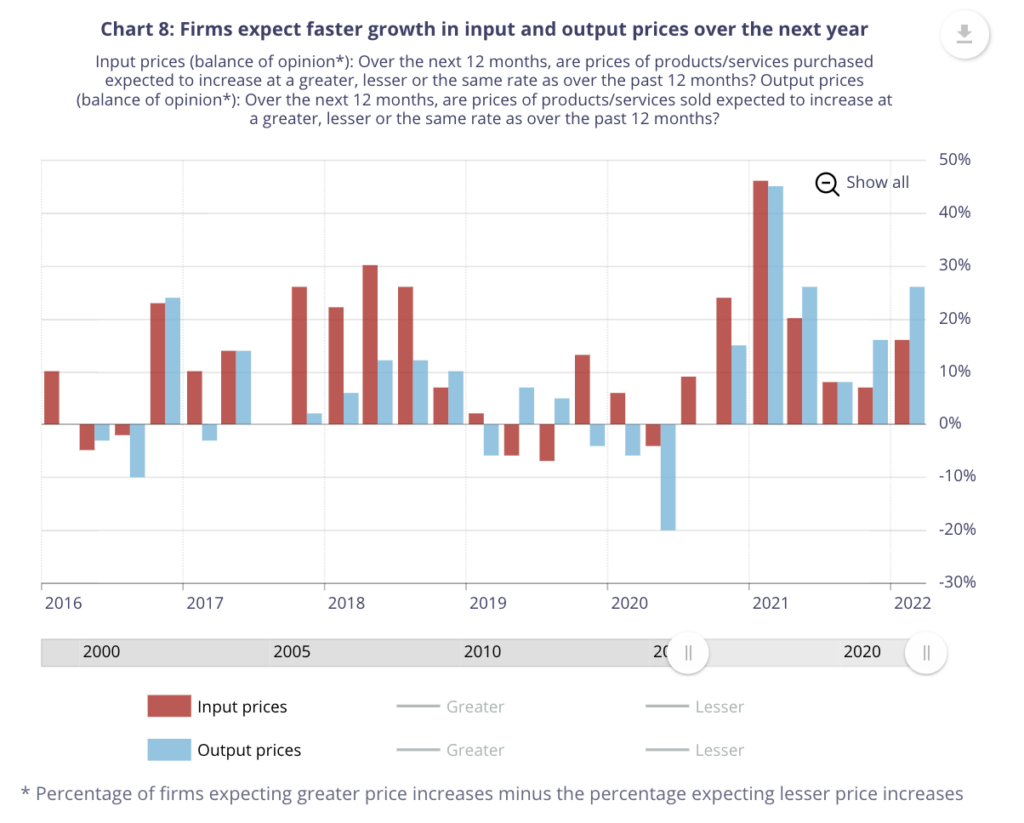

With labour market constraints and input material shortages failing to show signs of abating anytime soon, a record number of companies are factoring substantial wage growth, higher input costs, and subsequent increases in output prices. The survey found that businesses expect prices to rise faster for non-commodity input materials such as packaging, transportation, and electronic components, which are often related to ongoing supply constraints.

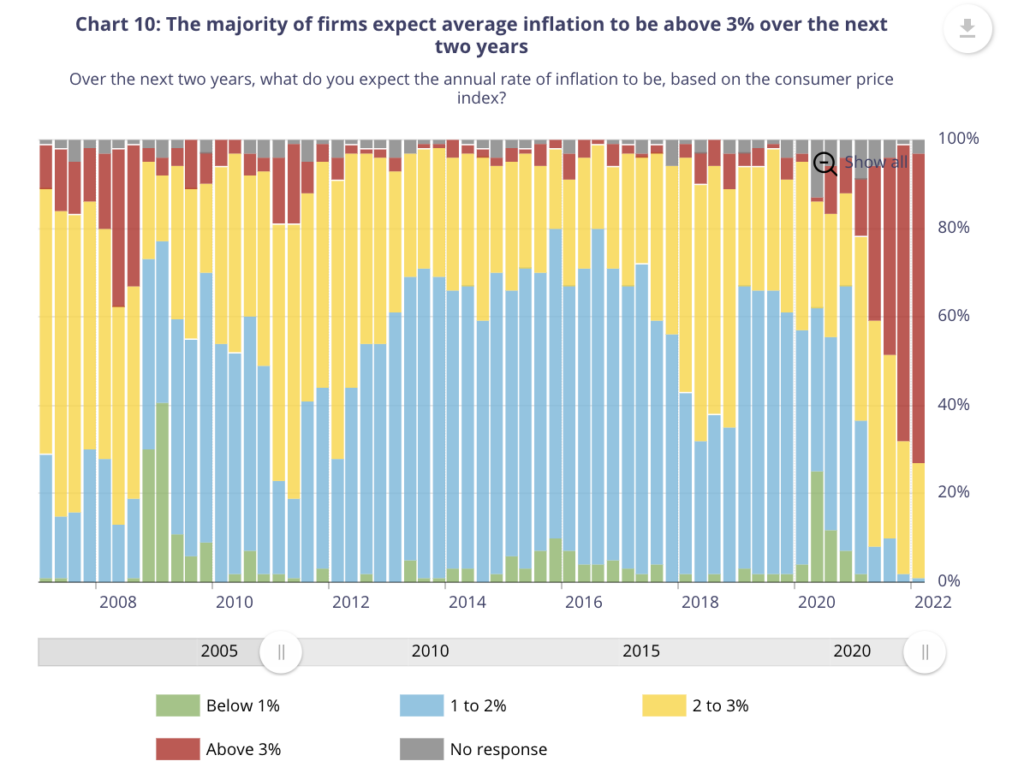

As a result, the number of businesses planning to pass higher costs onto consumers remains elevated, as strong demand allows them to raise selling prices more easily. With that in mind, over two-thirds of those firms surveyed expect inflation will be above 3% over the next two years, while two-fifths said it will be higher than 4%.

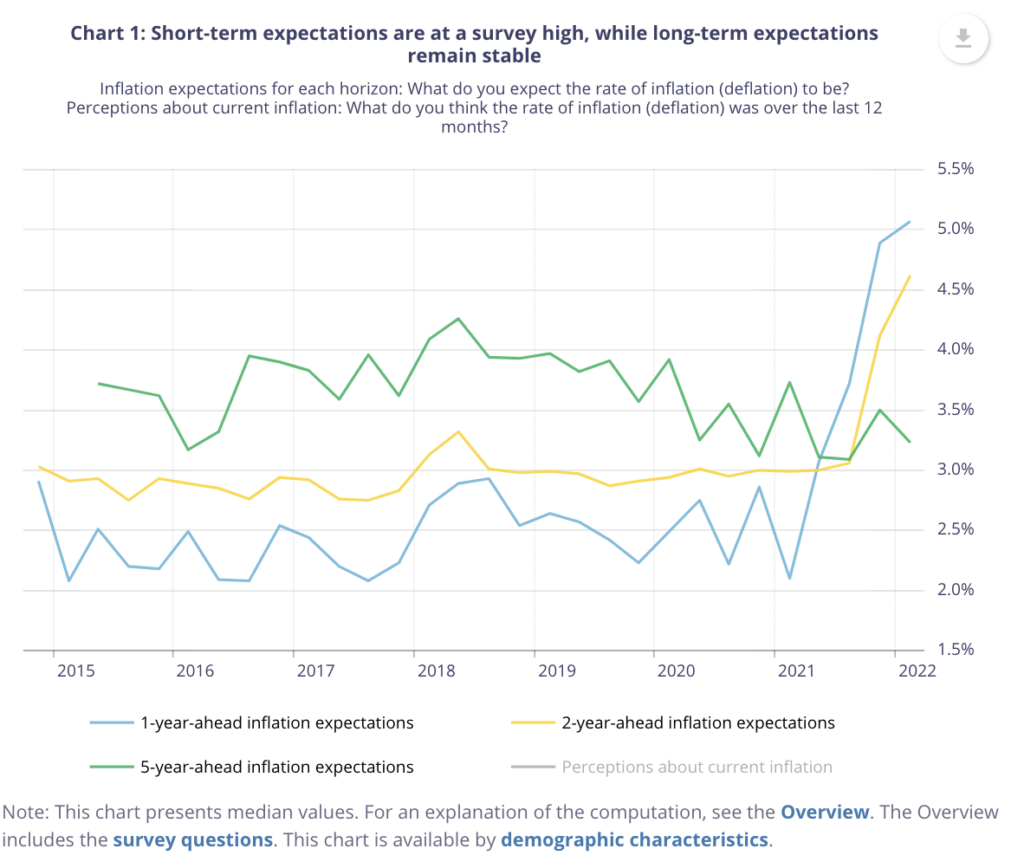

A separate survey of consumer expectations for the first quarter of 2022 echoed similar sentiment, with short-term inflation expectations for food, gas, and rent soaring to the highest on record. Canadians have become more concerned about broadening price pressures compared to the onset of the pandemic, and believe policy makers will face difficulties in taming inflation.

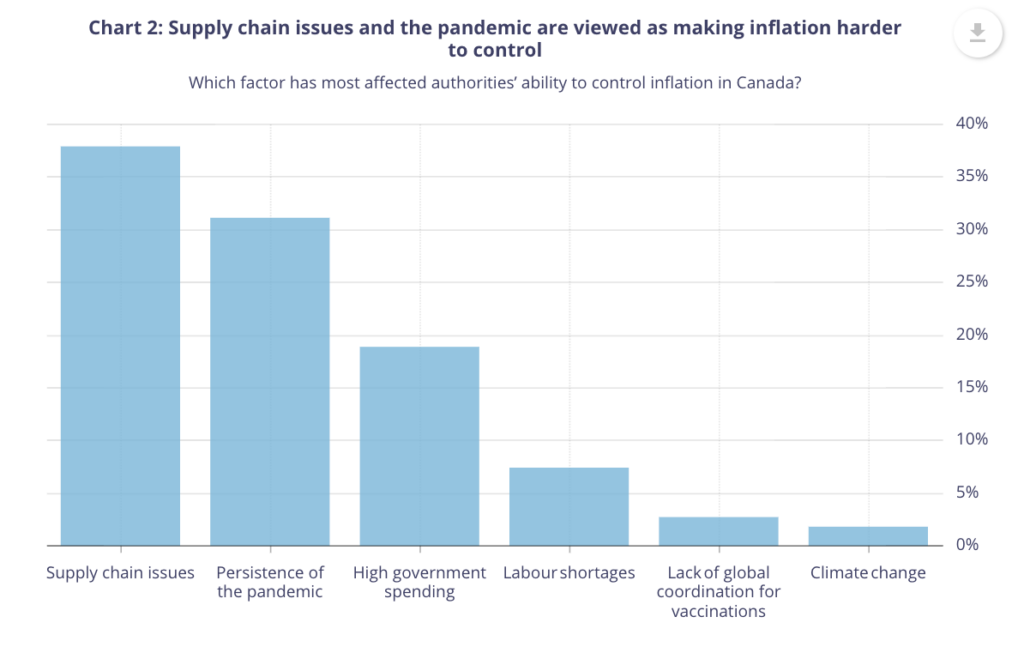

Respondents cited supply chain issues, an ongoing rise in Covid-19 cases, and elevated levels of government spending among the main issues contributing to out-of-control inflation. In fact, most Canadians anticipate supply chain disruptions will persist for at least two more years, and could even worsen amid the war in Ukraine. Some respondents believe prices will not subside even once supply chain issues are resolved, given that businesses will need to recoup profit margins.

Information for this briefing was found via Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.