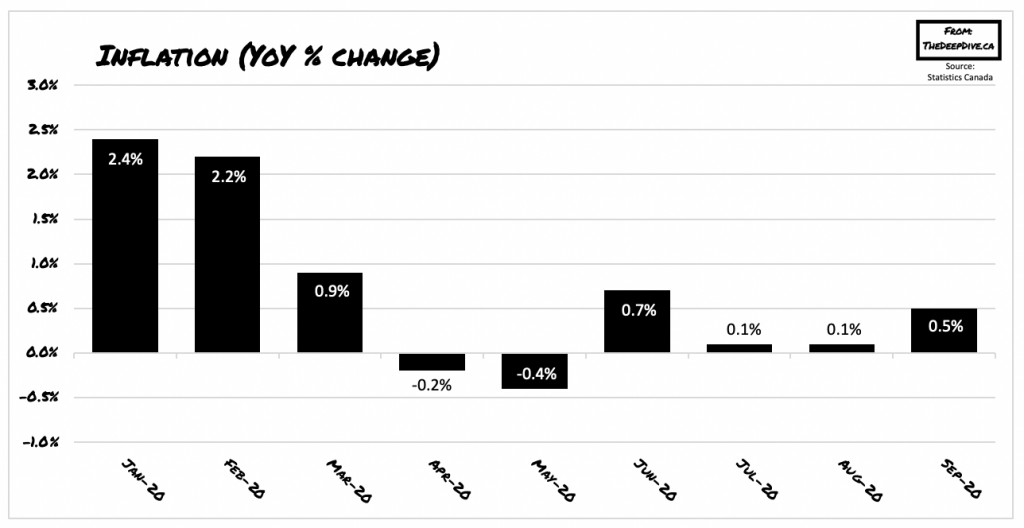

It appears that inflation has finally hit Canada, but price pressures still remain restrained as the economy attempts to climb out of the pandemic-induced recession.

According to the latest Statistics Canada data, annual inflation rose to 0.5% in September, after remaining constrained at 0.1% throughout July and August. Although inflation increased last month, it still remains significantly lower than usual levels as businesses and companies continue to keep prices depressed. This in turn has signalled to the Bank of Canada to maintain interest rates at record-low levels in order to stimulate growth.

In the meantime, the average of core inflation indicators, which provide a more thorough picture of underlying price pressures, increased from 1.7% in August to a mere 1.73% in September. Previously, economists had anticipated that core inflation readings would remain the same at 1.7%, which is below the central bank’s inflation target of 2%.

On a month-over-month basis, prices declined by 0.1%, but excluding gasoline, consumer prices increased by 1%. The latest Statistics Canada report suggests that gathering restrictions and social distancing rules imposed on businesses are preventing prices from spiking. However, the trend is unlikely to reverse anytime soon given the growing concerns of a second COVID-19 wave mounting across several major Canadian cities.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.