Hedgeye Risk Management, an investment research firm based in the U.S. state of Connecticut, published a regression analysis model which forecasts an exponential increase in the price of Bitcoin over the next ten years, namely US$10 million per Bitcoin at some point next decade. While such a moonshot feels quite unlikely — some might say laughable — particularly at a time when Bitcoin has lost fully half its value over just the last ten weeks, the research firm’s model has quite accurately predicted Bitcoin pricing over the last 10+ years.

The crux of the model, which mirrors theories published by a Dutch institutional investor who operates under the Twitter account “PlanB,” is the calculation of a metric called Stock-to-Flow, which is the ratio between current supply of a precious commodity (such as gold or Bitcoin) and the new supply of that commodity. For example, about 18.74 million Bitcoin are currently in existence, and, after the most recent Bitcoin halving event in May 2020 (see just below), about 344,000 Bitcoin are mined each year, making Bitcoin’s Stock-to-Flow ratio around 54.5x.

(After the creation of every 210,000 Bitcoin blockchain blocks, which occurs approximately every four years, the block reward is halved. As of May 11, 2020, the winning miner in each 10-minute block receives 6.25 Bitcoin, plus transaction costs, down from 12.5, 25 and 50 in the previous four-year periods, respectively. Phrased differently, the number of newly minted Bitcoin dropped to a 900 per-day pace on May 11, 2020 from an 1,800-daily rate over the four years ended May 10, 2020.)

For comparison purposes, the Stock-to-Flow ratios of gold and U.S. housing units are around 69x and 90x, respectively.

| Bitcoin | Gold | U.S. Housing Units | |

| Bitcoin in Existence | 18,738,275 | ||

| Bitcoin Mined Each Year | 344,000 | ||

| Gold in Existence (tons) | 190,000 | ||

| Gold Mined Each Year (tons) | 2,750 | ||

| U.S. Housing Units | 141,000,000 | ||

| U.S. Housing Starts Per Year | 1,572,000 | ||

| Stock-to-Flow Ratio | 54.5 | 69.1 | 89.7 |

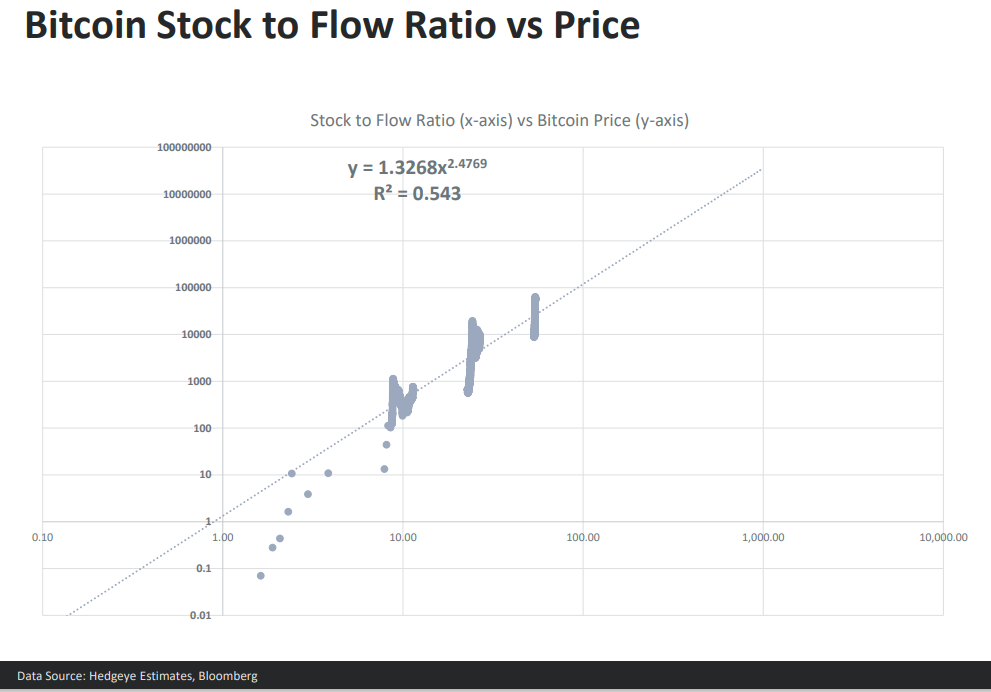

Bitcoin’s Stock-to-Flow ratio will increase dramatically over time in a pre-designed fashion due primarily to further Bitcoin halving events occurring about every four years. Ultimately, 21 million Bitcoins will eventually exist. The figure below maps the achieved Bitcoin price on the y-axis versus the Bitcoin Stock-to-Flow ratio corresponding to each Bitcoin price over the last 12 years on the x-axis.

A regression analysis produces a best fit curve for the data of Bitcoin Price = 1.3268 times Stock-to-Flow ratio raised to the 2.4769 power. According to this formula, the Bitcoin price when the Bitcoin Stock-to-Flow ratio is 54.5 should be about US$26,500.

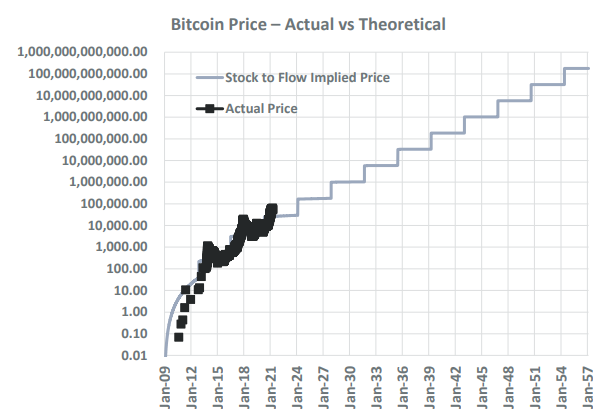

The next graph shows actual Bitcoin prices and the model’s predicted Bitcoin prices for years through 2057 based on the known Bitcoin Stock-to-Flow ratios in each year. Note that the step changes in projected Bitcoin prices are due to the quadrennial Bitcoin halving events, which cause step changes in the Stock-to-Flow ratio at each juncture. To this point, Bitcoin prices have closely tracked Hedgeye’s model.

Of course, a simple Bitcoin price predictor based on one variable, Stock-to-Flow, could prove far less accurate in the future than it has to this point for two main reasons. First, the model assumes that the market capitalization of a monetary good traces directly to its rate of new supply, and to no other factor. No research has been put forward to prove this idea.

Second, the fact that a linear regression analysis produces “good” statistical results in the form of a high R-squared does not necessarily mean that Stock-to-Flow ratios are the sole determinant of Bitcoin prices. Other key variables may be central to Bitcoin price discovery but were not reflected in the study (and the Stock-to-Flow ratio could have coincidentally aligned with those variables but did not represent causation).

Hedgeye Risk Management’s regression model is keyed to the one variable that Bitcoin bulls most ardently cite — Bitcoin scarcity. Only 21 million Bitcoin will ever be created, and the amount available to be mined decreases by 50% every four years. Consequently, the Hedgeye model perhaps relies too much on scarcity as a Bitcoin price predictor. However, the close syncing of the model to actual Bitcoin prices over the past 12 years is interesting.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.