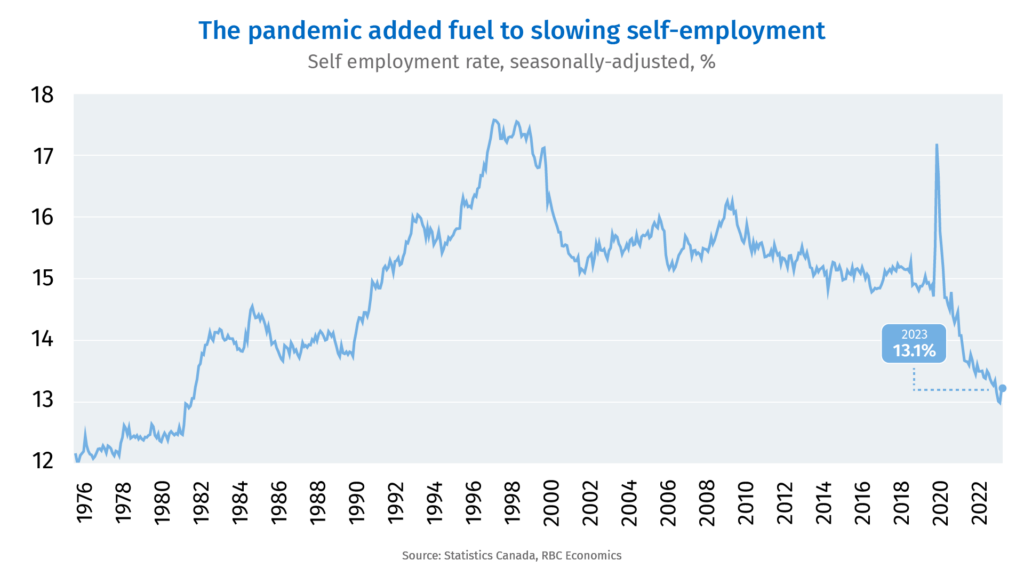

The allure of entrepreneurship appears to be waning dramatically in Canada as per a report by the Royal Bank of Canada. The pandemic, robust labour markets, and rampant inflation are rapidly accelerating a trend that has been in motion for decades: the decline in the self-employment rate.

While some may think this decline in self-employment emerged post-pandemic, that’s not entirely true according to RBC. The pandemic simply fast-tracked what was already in progress. What was once dominated by industry-specific factors, especially in the goods sector, has now evolved into a broader challenge.

Why work for yourself when employees in fields like professional and technical services rake in an impressive 20% more hourly than their self-employed counterparts? Add in the enticing prospect of flexible work environments, and it’s clear why the entrepreneurial spirit seems to be dying out.

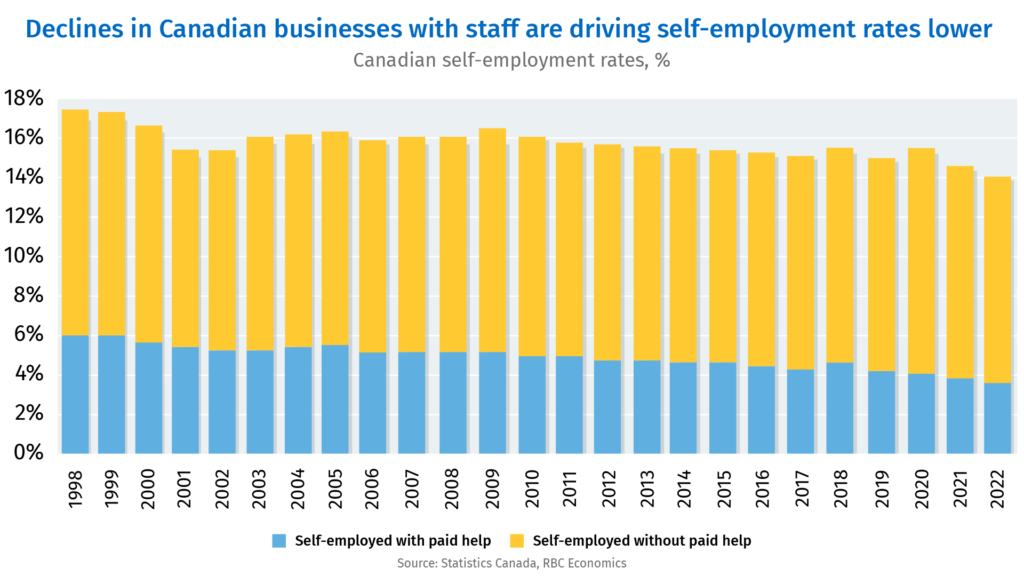

A deeper dive into the numbers reveals an even grimmer picture. Only 13% of Canadian workers are self-employed as of 2022, and a mere 4% of them have employees. What’s more concerning? A staggering 50% of the decline in self-employment during the pandemic can be attributed to businesses with paid help. This implies that the very core of entrepreneurship – businesses with growth potential and job creation – is facing a dire situation.

And there’s another ticking time bomb: Canada’s aging population. As Baby Boomers march towards retirement, a vast number of small businesses are set to shut their doors. Given that only 9% of them have a succession plan, who will step in to fill the void?

The hopes might have been pinned on Canada’s younger generations, but here too, the statistics are not promising. A mere 2% of Canadians aged 35 to 44 are looking to venture into self-employment, down from 3.3% in 1998.

RBC also expects things to get worse before they potentially get better. With rising interest rates and living costs, coupled with housing affordability concerns and persistent labor shortages, the path for small businesses looks difficult at best.

Information for this story was found via Royal Bank of Canada, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.