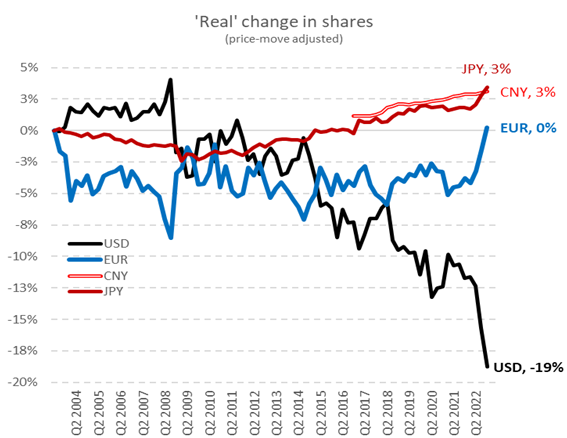

The dominance of the US dollar as the primary global reserve currency faced a significant setback last year, declining at a rate ten times faster than the average over the past two decades. This trend emerged as numerous nations sought alternatives following the fallout from Russia’s invasion of Ukraine, which triggered swift and robust sanctions, according to insights from currency experts Stephen Jen and Joana Freire of Eurizon SLJ Capital Ltd.

Jen, renowned for his development of the dollar smile theory during his tenure at Morgan Stanley, alongside Freire, highlighted the remarkable decline in the dollar’s market share as a reserve currency throughout 2022. They attributed this decline primarily to the extensive utilization of sanctions by the United States and its allies in response to geopolitical tensions.

“The dollar suffered a stunning collapse in 2022 in its market share as a reserve currency, presumably due to its muscular use of sanctions,” they wrote.

In the wake of the conflict, Bloomberg’s greenback index experienced a surge of up to 16%, fueled by rising global inflation and subsequent interest rate hikes, which impacted both bond and currency markets. Despite this, the dollar concluded the year with a 6% increase, underscoring its resilience amidst tumultuous economic conditions.

Notably, smaller nations have begun exploring de-dollarization strategies, while economic powerhouses like China and India are actively advocating for the internationalization of their currencies for trade settlement.

These initiatives gained traction after the US and Europe severed ties with Russian banks through the SWIFT financial messaging system, prompting concerns about the dollar’s potential weaponization for political ends.

The data reveals a notable shift in the dollar’s share of global official reserves, declining from 73% in 2001 to approximately 58% today. Despite this decline, Jen and Freire caution against prematurely dismissing the dollar’s role as the dominant international currency, citing the continued reliance on its large, liquid, and well-established financial markets, particularly by developing nations.

However, they caution that this status quo is not guaranteed, emphasizing the growing reluctance among emerging economies to solely depend on the dollar for transactions.

“What needs to be appreciated by investors is that, while the Global South is unable to totally avoid using the dollar, much of it has already become unwilling to do so,” they reiterated.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.