Kontrol Technologies Corp. (NEO: KNR) released two major pieces of news this week that point to the potential outlook of the Canadian tech firm.

On Tuesday, the firm announced that its BioCloud technology has shown potential to detect the influenza virus in an initial testing done in Japan.

“The BioCloud technology innovation is based on taking a manual laboratory process and automating that process in real-time, with the goal of monitoring ambient air for early viral detection,” says President Gary Saunders.

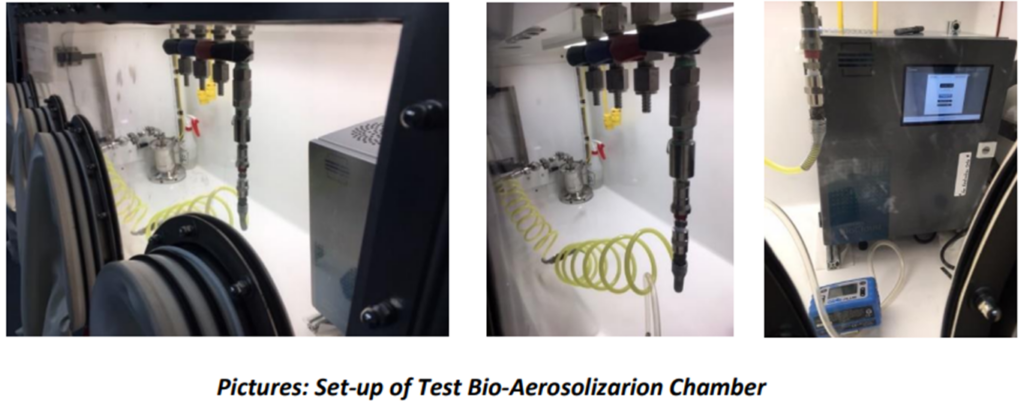

What this means is there’s a possibility for the BioCloud devices “to capture aerosolized influenza virus in its proprietary collection chamber”, which has a potential demand as the world reels in from the COVID-19 pandemic. Prior to this, the company has been marketing the device to monitor air quality and detect airborne pathogens, even providing the Olympic Canadian team five units during the Tokyo stint.

The company also announced on Wednesday a major contract secured through its recently acquired subsidiary Global HVAC and Automation. The contract is said to be worth $9.7 million–approximately 10% of the company’s market cap.

This falls within the $35.0 million “in new potential revenue opportunities” that the firm was then quoting as of December 2021, with $23.0 million quotation requests just recorded for that month. However, the firm also acknowledges its more than 67% batting average in converting these to revenue generation.

In 2020, the company earned annual revenue of $13.0 million, well below the retracted annual guidance of $32 – $35 million. The firm points the decline to COVID-19 deferring capital projects.

The tech firm previously announced a $33 – $35 million annual revenue guidance for 2021. For the nine months ended September 30, 2021, the firm has earned $29.0 million so far, with $21.5 million of which was recorded during Q3 2021 alone.

The company recorded its first positive net income during Q2 2021 at $0.2 million, followed by a consecutive $2.1 million net income in Q3 2021. Following these performances, the firm upsized its 2021 revenue guidance to $43 – $46 million from the $38 million adjusted estimate and its adjusted EBITDA guidance to $6 – $7 million from the $3.7 million estimate.

Also announced in December 2021, one of the company’s key strategies in 2022 was to uplist to a major US stock exchange–just mere 10 months after it shifted from Canadian Securities Exchange to Neo Exchange.

While there’s a lot going on for Kontrol, it has yet to prove its consistency in having a–well, control–over the course of its company.

Kontrol Technologies Corp. last traded at $1.88 on the NEO.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.