Lithium equities including SQM (NYSE: SQM), Albemarle Corporation (NYSE: ALB), Arcardium Lithium (NYSE: ALTM), Sigma Lithium (NASDAQ: SGML), and Piedmont Lithium (ASX: PLL) experienced notable gains recently, climbing amidst shifting market dynamics and speculation surrounding supply disruptions.

Unconfirmed reports suggest the potential closure of the Chinese battery maker CATL’s Jianxiawo mine before the Chinese New Year. This closure, reportedly due to reluctance to continue production below US$13,000/t for lithium carbonate, has sparked discussions about its implications on the market.

Analysts are eyeing this development as a potential signal of pricing lows, with the closure of the mine potentially indicating that the market is nearing or reaching lows. There are concerns that this closure could shift the market from a 1% surplus to a 2% deficit in 2024.

Lithium shorts are in a spot if trouble it seems pic.twitter.com/blf0N6sfD0

— Mayor of Muntville (@dattosrule) February 18, 2024

However, analyst Dwayne Sparkes on X also pointed out that recovery rates are often overlooked in supply forecasts. The transition from SC6 to SC5.5 by Sigma, for instance, is expected to result in decreased recoveries due to higher deleterious elements, impacting planned lithium carbonate equivalent (LCE) production.

Despite these uncertainties, Sigma reported production highlights and targets for the quarter, including 38,500t of 5.5% Triple Zero Green Lithium in Q3. The company aims to sustain a 65% recovery rate and expects revenue equivalent to 130,000t production of Triple Zero Green Lithium and By-Products in Q4.

Looking ahead, Sigma has outlined its planned Phase 1 production and estimated Phase 2 scale-up. The updated feasibility study targets 230,000 tpa (34,000 LCE) of 6% Battery Grade Sustainable Lithium over 8 years. Financial projections suggest significant potential, with an after-tax NPV potentially reaching US$1.9 billion and an impressive IRR of 424%.

As i sip my usual morning coffee, reading through lithium supply forecasts, I'm noticing a regular pattern.

— Dwayne Sparkes (@sparkes_dwayne) February 18, 2024

An important factor that a lot of these analysts are forgetting/overlooking in their lithium supply forecasts is just how much recoveries suffer when in operation. It… pic.twitter.com/QRJYJLR0Ry

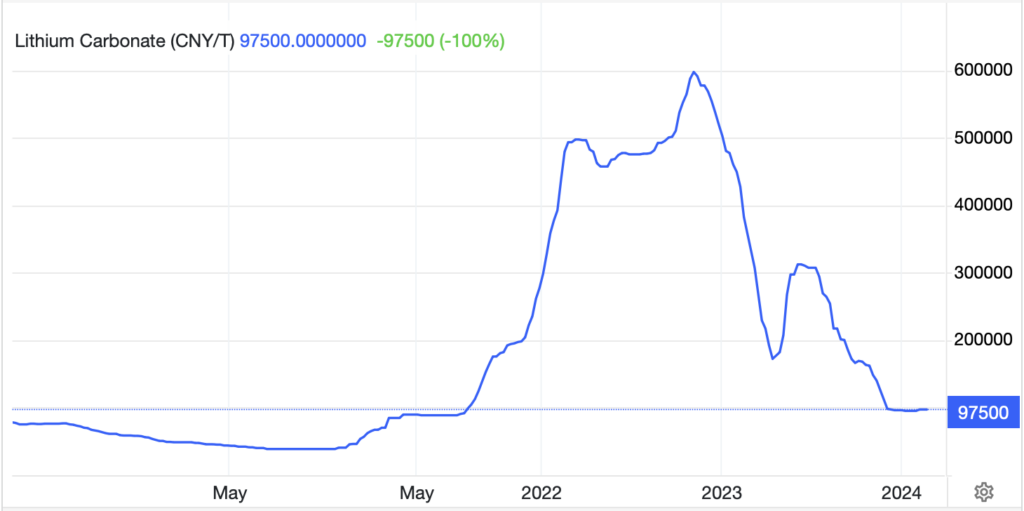

The lithium market has been facing challenges, with lithium carbonate prices hovering around CNY 97,500, remaining close to the near 3-year low of CNY 95,500. This situation has been exacerbated by a considerable surplus, driven by a slowdown in electric vehicle sales in China, limiting lithium demand for battery manufacturers.

Forecasts now suggest that the next lithium deficit may not return until 2028, marking a departure from earlier speculation of persistent shortfalls that had lifted lithium prices to CNY 600,000 in November 2022.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.