Fed Chairman Powell’s late August speech in which he reiterated plans to continue raising interest rates to combat inflation, coupled with the mid-September release of hotter-than-expected August U.S. Consumer Price Index data, have turned investor sentiment decidedly sou. Indeed, Bank of America’s strategist Michael Hartnett says that investors are increasingly turning to cash and that overall sentiment is “unquestionably” at its lowest point since the 2008 global financial crisis.

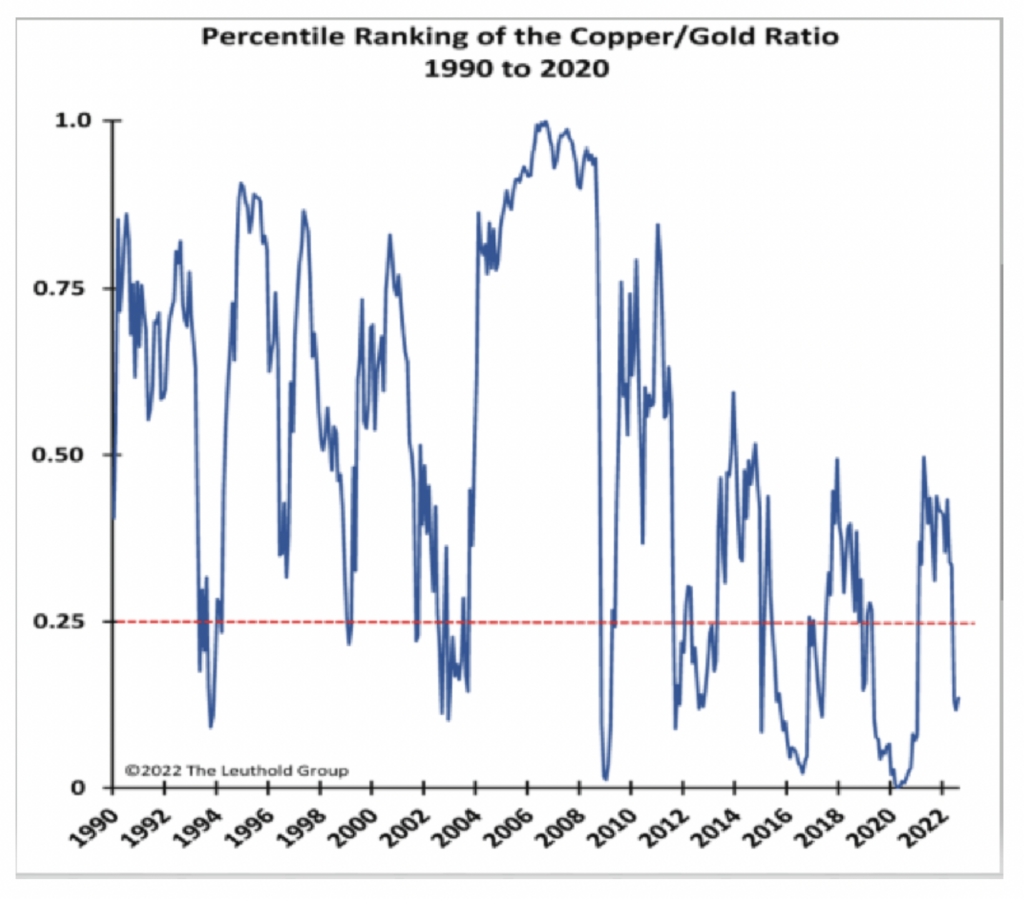

Given the near unanimity of bearish views — interestingly, after an approximate 20% decline in the S&P 500 Index — a recently published study by the Leuthold Group suggests the relative performance of economically-sensitive copper prices to gold prices is an interesting counterpoint, particularly for short-term oriented investors. Historically, investors have turned to gold as a store of value during times of recession concerns, or when they fear recession or high market volatility.

The theory is that when the ratio of copper to gold prices gets beaten down to sufficiently low levels, investors have already discounted most of the bad news; and the next short-term move in the market can be a marked upward move. Phrased differently, when the ratio is low, there is far more fear than greed reflected in stock prices. When the ratio is high, investors have too much confidence in the future performance of stocks.

The ratio has been higher than it is now 87% of the time since 1990. The only times when the ratio was lower than the current reading were at the trough of the 2008/2009 stock market correction; just before President Trump surprisingly won election in the fall of 2016; and the lows when COVID-19 began to spread in early spring of 2020.

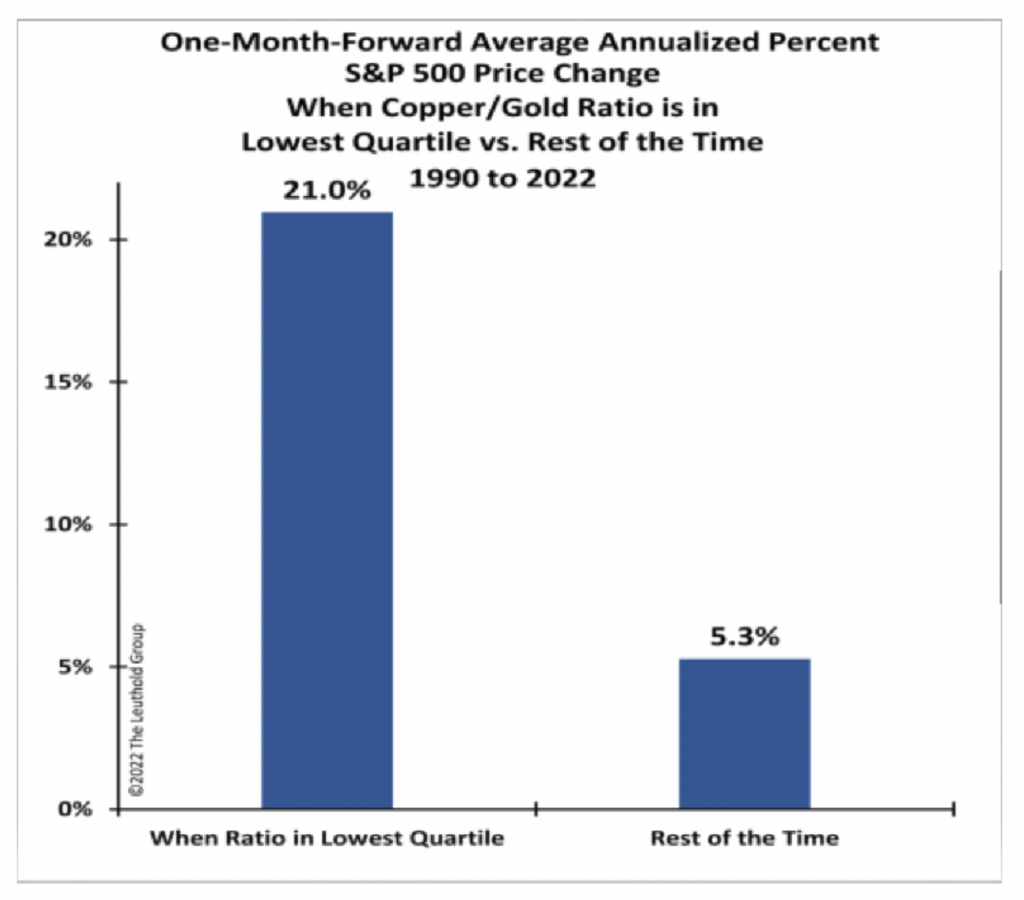

According to Leuthold Group, the S&P 500 has risen at an average annualized rate of about 21% over the next month after the indicator fell to a level in the 25th percentile or lower. Conversely, when the ratio is in the 26thpercentile or higher, the average annualized stock market return in the next month is just over 5%.

Note that while a sharp drop in the copper-gold ratio has historically been followed by a sharp move upward in the following month, it is not a foolproof rule. About 29% of the time when the metric was in the bottom quartile in the first graph above, the stock market posted a decline in the subsequent month.

Information for this briefing was found via The Leuthold Group and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Thank you for this insightful piece, which can assist gold investors in better understanding this topic, how it operates, and the benefits of investing in gold, particularly for those who are just starting out.