In one of the most constructive developments for the uranium mining industry in some time, a bi-partisan U.S. Senate committee advanced a bill that would establish a strategic uranium reserve in America. In early December, the Committee on Environment and Public Works passed the American Nuclear Infrastructure Act (ANIA), which would mandate that the Department of Energy buy uranium from facilities licensed by the U.S. Nuclear Regulatory Commission. According to the legislation, companies owned or controlled by China or Russia are banned from participation.

Of course, the legislation has not yet passed the full Senate, meaning it has also not been discussed by any committee in the House of Representatives, much less the full House. However, the bi-partisan support in the Senate committee, together with President-elect Biden’s reported positive views toward the sector, could signal improving times for uranium miners with mines on American or Canadian soil, such as IsoEnergy Ltd. (TSXV: ISO). President elect Biden’s Democratic Party platform specifically cited nuclear technologies as one means to de-carbonize the U.S. electric power sector.

Since stocks of many uranium miners have been disappointing investments for a long period of time, the U.S. action could be a positive catalyst, particularly for a well-capitalized miner like IsoEnergy. The company holds a large, high-grade uranium deposit in the Athabasca Basin. Uranium mined from such a deposit could play an important role if and when the U.S. begins to build and continue to fill its strategic reserve.

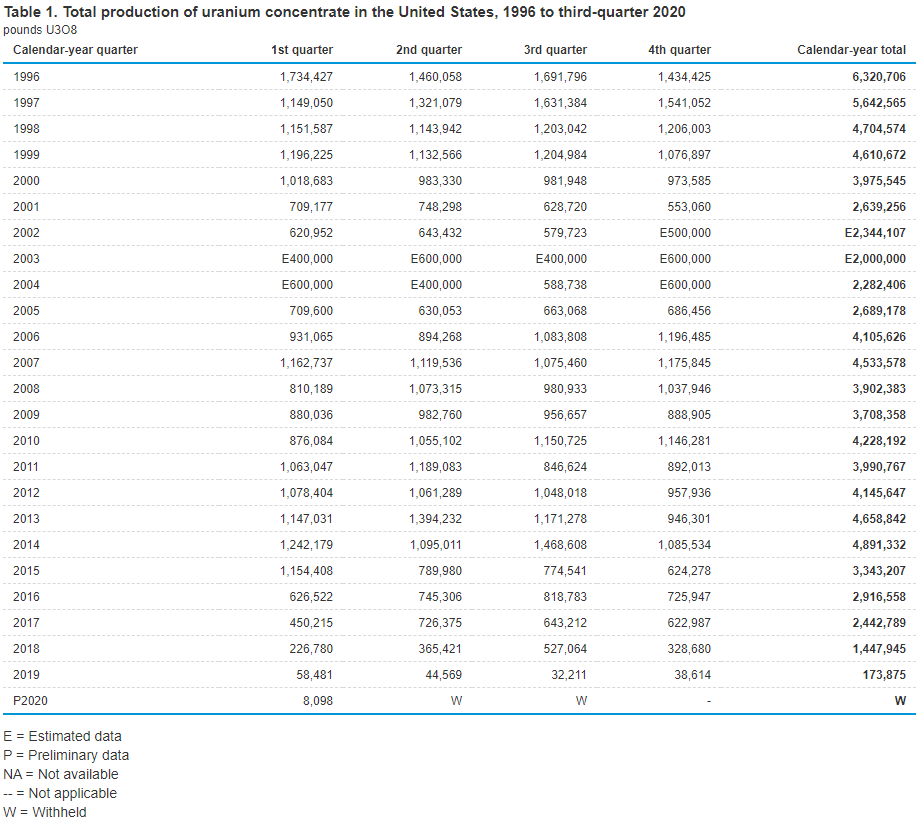

Virtually No Uranium is Currently Produced in the U.S.

Uranium is imported into the U.S. primarily by producers in Canada, Kazakhstan, Australia, and Russia. Uranium producers in Australia and Canada are not state subsidized, but those in Kazakhstan and Russia are generally thought to be. Almost no uranium is currently produced in the U.S.; this represents a sharp contrast to the fairly robust domestic mining industry as recently as five years ago.

IsoEnergy : Fairly Modest Operating Losses and Operating Cash Flow Deficits; Solid Balance Sheet

A pre-revenue company, IsoEnergy has controlled its operating losses and operating cash flow deficits well over the past five quarters. The company has sold equity twice over that period, and raised an additional $4 million in a private placement this month, to maintain ample cash on its essentially debt-free balance sheet. Shareholders have encountered dilution with this capitalization strategy, as shares outstanding have increased more than 30% in the past year.

| (in thousands CAD$, except shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($415) | ($562) | ($636) | ($636) | ($547) |

| Operating Cash Flow | (235) | (594) | (647) | (420) | (381) |

| Cash | 12,798 | 2,726 | 3,723 | 6,587 | 988 |

| Debt – Period End | 167 | 181 | 195 | 209 | 223 |

| Shares Outstanding (Millions) | 91.2 | 84.3 | 84.3 | 84.3 | 68.4 |

Passage of the ANIA bill is by no means certain, particularly given the volatile state of U.S. politics. If the bill were to die or be set aside for a lengthy period, any enthusiasm for the uranium mining industry could dim, and shares of miners like IsoEnergy could suffer.

Conclusion

IsoEnergy is essentially a speculative bet that the North American uranium mining industry could be revived by the progress and ultimate passage of the ANIA bill. Stocks of uranium miners have been ignored by investors for many years, and positive news could finally cause sentiment to change. IsoEnergy is a well-capitalized miner, and this strength could limit the downside for the stock if the bill were to progress slowly or be delayed.

IsoEnergy last traded at $1.90 on the TSX Venture Exchange.

Information for this briefing was found via Sedar, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.