Israel’s central bank has made the biggest reallocations to its foreign currency reserves in over a decade. They will be slashing their reserves for the US dollar and euro to make room for the Chinese yuan, Japanese yen, and Canadian and Australian dollars.

Including the British pound, the Bank of Israel will now have seven currencies in its foreign exchange holdings that at the end of March were worth over US$206 billion according to Bloomberg. The country’s foreign exchange stockpile, which has surpassed a third of its gross domestic product, breached the US$200-billion mark for the first time ever in 2021.

The 2022 allocations bring down the US dollar’s share from 66.5% to 61%, and the euro’s share will be slashed from 30.8% to 20%, the lowest in a decade. The pound, on the other hand, will make up almost double its 2021 share from 2.7% to 5%.

According to the bank’s annual report, allocations of the new additions will see the yen accounting for 5%, Canadian and Australian dollars at 3.5% each, and the yuan at 2%.

This new currency configuration sets a standard that’s closer to the rest of the world and reflects Israel’s changing trade flows. According to Bloomberg, while Israel’s biggest trade partner is still the US, its overall volumes with the Asian economy have almost doubled from 2016 to 2021.

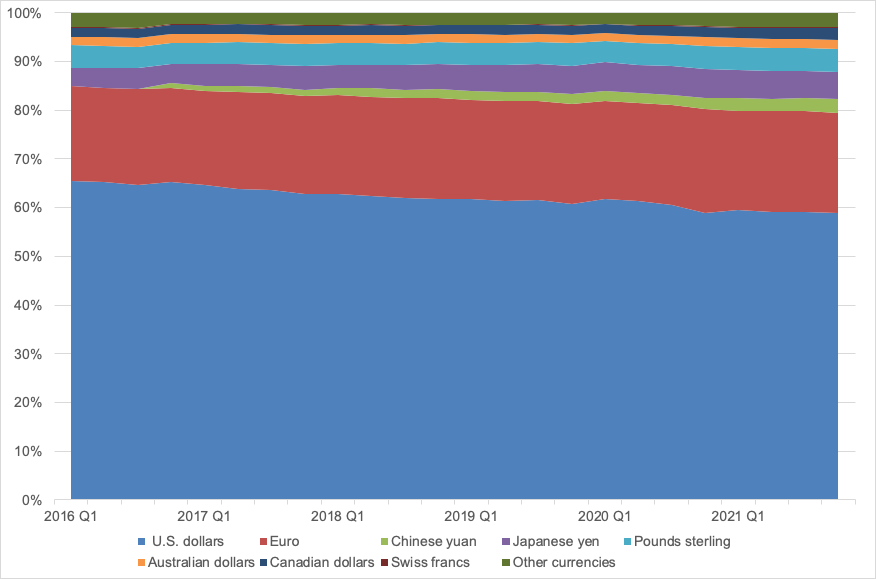

According to the International Monetary Fund, the US dollar’s share of global currency reserves is at its lowest in over 25 years.

Source: IMF

The yuan’s share, while still minuscule compared to the US dollar, meanwhile continues to enjoy steady growth.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.