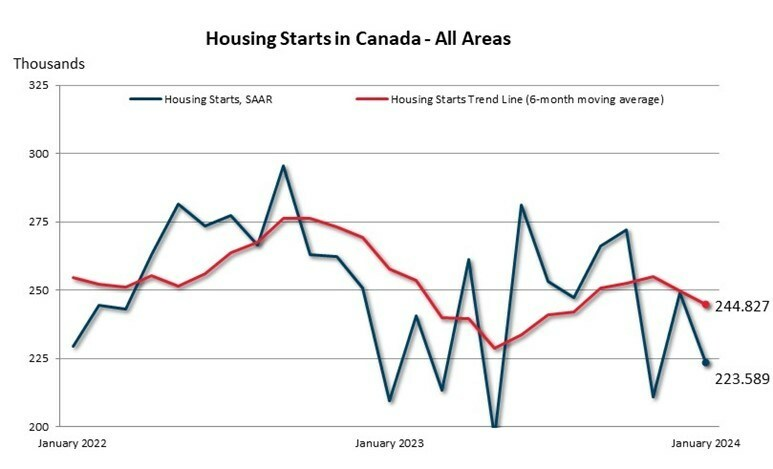

In January 2024, the Canadian housing market presented a mixed bag of results, underscoring the challenges facing the sector amidst economic uncertainties. Data from the Canada Mortgage and Housing Corporation revealed a notable 10% decline in the Seasonally Adjusted Annual Rate (SAAR) of housing starts, falling to 223,589 units from December 2023’s 248,968 units.

This downturn marks a concerning shift in momentum, as the six-month trend also slid 2% to 244,827 units, reflecting potential headwinds in housing development.

Despite this overall decline, a silver lining emerged in the actual number of housing starts in urban centers, which saw a 13% year-over-year increase to 14,878 units in January 2024. The regional disparities however are stark. Toronto’s housing starts surged by 49% year-over-year, which contrasts sharply with significant downturns in Vancouver and Montreal, where starts plummeted by 44% and 6%, respectively.

This uneven landscape suggests a deeper issue within Canada’s housing strategy, where certain regions are experiencing booms while others face stagnation or decline. The emphasis on multi-unit developments, while beneficial for addressing housing shortages, may not meet the diverse needs of all Canadians, including those seeking single-family homes.

Moreover, the drop in the SAAR of housing starts signals a cooling period that could have broader implications for Canada’s economy. Construction is a significant driver of economic activity, and a slowdown in this sector could ripple through to employment, consumer spending, and overall economic growth.

Information for this briefing was found via CMHC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.