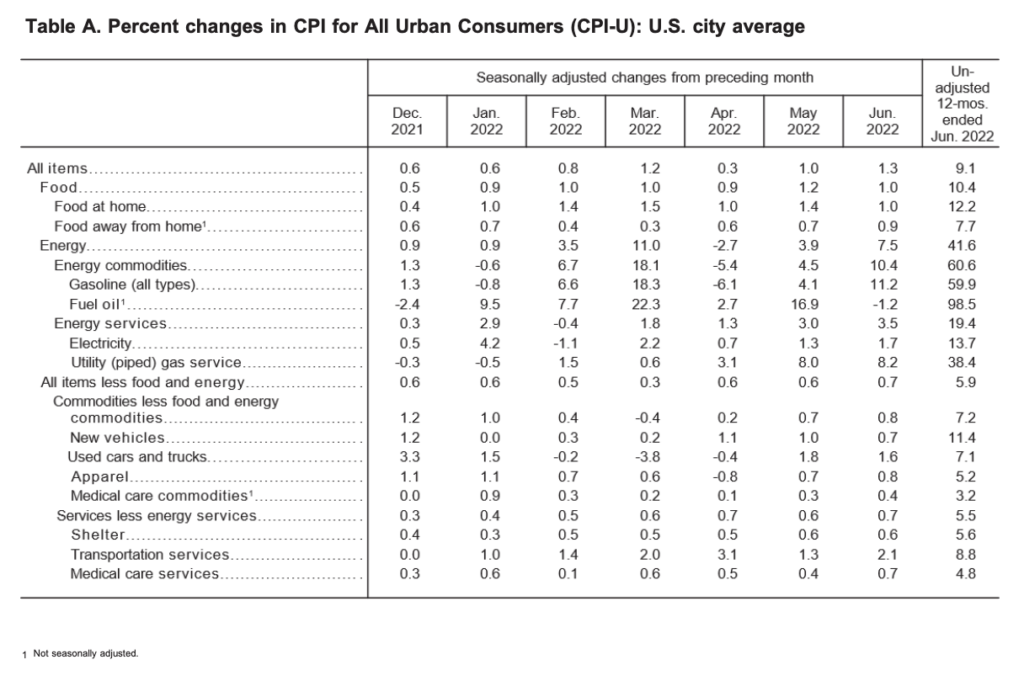

The Federal Reserve on Wednesday delivered on a much-anticipated 75 basis-point rate hike, whilst acknowledging the US economy is weakening from pandemic highs— but is not a recession!

With inflation at 40 year-highs, and spending and job production on the decline, Fed Chair Jerome Powell walked a very narrow tightrope today, putting all efforts into not saying the infamous “R-word.” But, panic over the state of the economy was certainly there, after FOMC members unanimously agreed to hike borrowing costs by 75 basis-points for the second consecutive time, bringing the overnight rate to a range between 2.25% and 2.5%.

JUST IN: Federal Reserve Chair Jerome Powell says inflation is too high.

— Watcher.Guru (@WatcherGuru) July 27, 2022

In attempting to deliver a glimmer of hope, though, the FOMC did affirm that “job gains have been robust in recent months,” and blamed Vladimir Putin on the “upward pressure” on inflation and downward weight on the economy. (Absurdly, pure ignorance was given to the fact that inflation was soaring exponentially higher long before the conflict in Ukraine, but we digress.)

“I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well,” said Powell during a press conference. “This is a very strong labor market … it doesn’t make sense that the economy would be in a recession with this kind of thing happening.”

BREAKING: THE FED SAYS INFLATION WON’T CAUSE RECESSION CAUSE IT MAKES EVERYTHING GO UP NOT DOWN

— Not Jerome Powell (@alifarhat79) July 27, 2022

But, upcoming economic data will likely suggest otherwise. With preliminary GDP data slated for release on Thursday, economists polled by Dow Jones are forecasting a paltry expansion— if any expansion at all— in the second quarter, following a worrisome 1.6% decline in the first three months of 2022.

For reference, here is the textbook definition of a recession from the National Bureau of Economic Research: “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

From RBC on the FED pic.twitter.com/aOGk9YCTXm

— FCFYield (@FCFYield) July 27, 2022

But, with pesky inflation continuing to rear its ugly head, Powell said that another rate hike is on the table come the FOMC’s next meeting in September, and that the Fed won’t hesitate to deliver a larger move should it be deemed necessary. Welp, with that being said, we might not be in a recession right now, but we certainly will be!

Federal Reserve Chairman Jerome Powell: "We didn't expect a good reading, but this one was even worse than expected, I would say." pic.twitter.com/2pLQbHkymP

— The Post Millennial (@TPostMillennial) July 27, 2022

Information for this briefing was found via the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.