Although US inflation is showing signs of easing— albeit slowly, the Fed appears adamant on continuing its aggressive rate-hiking cycle.

Fed minutes released yesterday from January’s FOMC meeting show that policy makers are still worried about inflation sitting well above the central bank’s 2% target range, while the labour market, “remains very tight, contributing to continuing upward pressures on wages and prices.” As such, committee members noted that “substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path,” adding that “ongoing” rate hikes are imperative.

The next FOMC meeting starts in just 28 days. pic.twitter.com/wvxG8vAAES

— Rudy Havenstein, The Internet's Chief Futurist. (@RudyHavenstein) February 21, 2023

In February, policy makers approved a 25 basis-point rate increase, bringing borrowing costs to a target range of 4.5% to 4.75%. However, Fed Chair Jerome Powell failed to give an indication of the size of potential upcoming rate increases, since policy makers still remain divided on the issue. In a recent interview with CNBC, St. Louis Fed President James Bullard suggested that an even more hawkish tightening cycle would give the central bank better control over bringing inflation down quicker.

“It has become popular to say, ‘Let’s slow down and feel our way to where we need to be.’ We still haven’t gotten to the point where the committee put the so-called terminal rate… You’ll know when you’re there when the next move could be up or down. Our risk now is inflation doesn’t come down and reaccelerates, and then what do you do? Let’s be sharp now, let’s get inflation under control in 2023,” he explained.

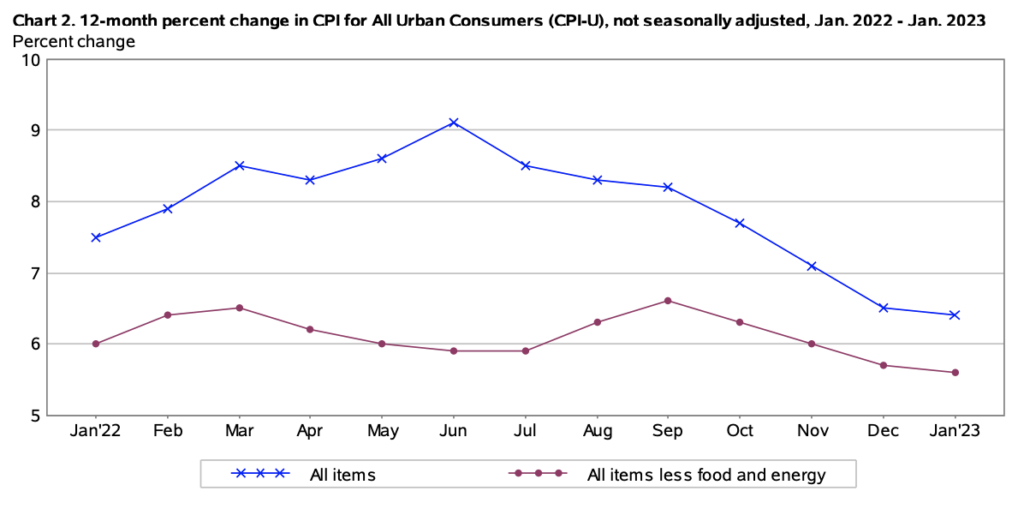

Data from the BLS showed that January CPI rose 0.5% from the month prior to 6.4%. Markets are anticipating another 25 basis-point rate increase come March, followed by two more rate hikes throughout the year to bring the target rate to a range between 5.25% and 5.5%.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.