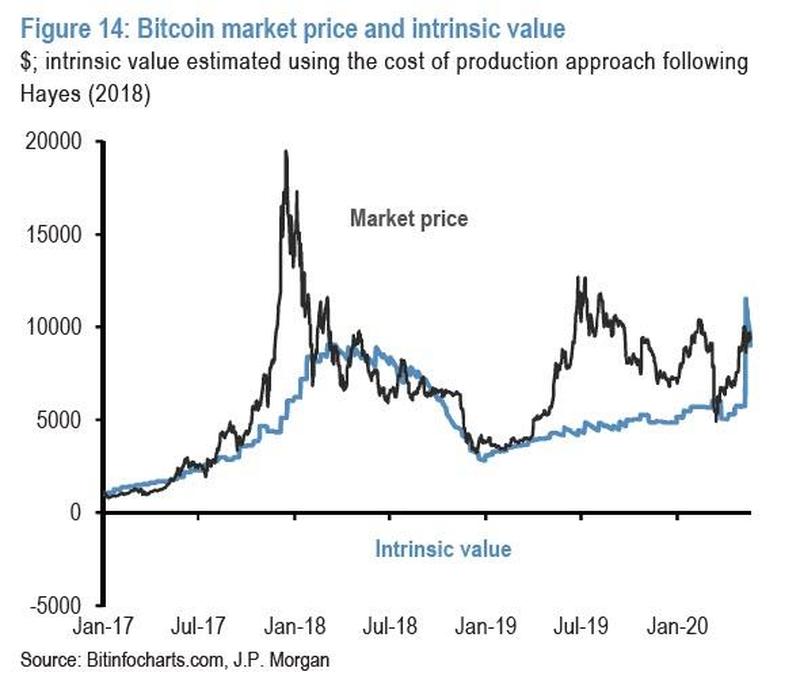

The last few years for Bitcoin have been somewhat of a roller coaster; the cryptocurrency gained significant traction in the beginning of 2017, hitting an all-time high price of nearly $19,000 by the end of that year. Shortly after however, Bitcoin’s volatility became evident, and the popular cryptocurrency’s price took a nosedive by over 80% within a duration of one year. Since then, such a high price has not been achieved, and Bitcoin slowly slipped out of the center of attention- until now.

JPMorgan recently released an eye-opening report, which provides some insights into Bitcoin’s valuation. Bitcoin is unique in the sense that its store of value is dependent on its utility as a medium of exchange. Since the cryptocurrency is not backed by a precious metal or a physical commodity, the only way it can derive its value is through speculative interest. As a result, it is relatively difficult to attach a valuation price tag on a cryptocurrency, and ultimately determine its real market price. Now however, several derivative strategists at JPMorgan were able to calculate Bitcoin’s intrinsic value, and ultimately put price speculation to rest.

In their model, they treated Bitcoin as a commodity in order to determine its marginal cost of production. In this case, the marginal cost of production is a function of input costs, such as the cost of electricity, computational power, and efficiency of hardware. Then, that function is divided by the amount of bitcoins that are produced each day, to ultimately determine the cost of production. From there on, after some more very complicated analysis, the cryptocurrency’s intrinsic value emerged.

Remember when Bitcoin emerged with its astronomical pricing at the end of 2017? Well it turns out its presumed value was heavily exaggerated, with the market price nearly double its actual intrinsic value. However, all of that is the past. Now, Bitcoin’s market price is right around where it should have been trading all along – the $9,000 to $10,000 mark.

Information for this briefing was found via Zero Hedge, Bloomberg, and JPMorgan. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

JPMorgan has done an excellent job with determining Bitcoin’s intrinsic value here. I appreciate this from JPMorgan, and hopefully, this person will continue to share costs of other trading coins, as well.