Junk Bond, Stock and Treasury Markets Have Conflicting Signals About The 2023 Economy

In a fitting end to a confusing financial year, the high-yield bond, stock and Treasury markets seem to have widely disparate views on the future. Specifically, junk bond investors anticipate a 2023 economy which dodges one of the most widely predicted recessions in history. On the other hand, the highly volatile NASDAQ index and U.S. Treasuries across the yield curve are trading like an economic downturn is a near certainty.

Junk bonds are trading at yield premiums of about 481 basis points (bp) over Treasuries, down from a 2022 peak of about 600 bp mid-year. Surprisingly, since these times feel anything but average, the current 481-bp premium is about the median extra yield quantity over the past 25 years.

During sharp downturns like the dot-com bust in the early 2000’s and 2008-2009 Financial Crisis, the extra yield necessary to offset the risk of a sharp downturn reached or exceeded 1,000 bp. Even for short periods in late 2011 and in 2016, the junk bond yield premium exceeded 700 bp for at least several months in each instance.

On the other hand, the NASDAQ Composite has plummeted 20% since mid-August (with little deviation in trend along the way) and 33% for the full-year 2022. The recent sharp declines in bellwether technology stocks seem inconsistent with an economy that would sail through 2023 without interruption.

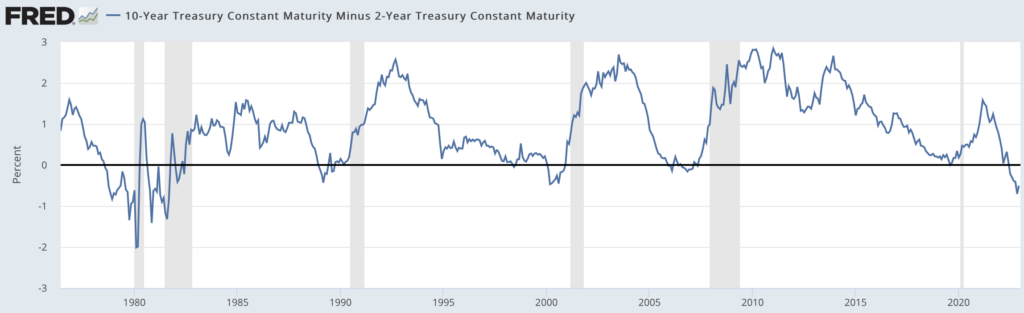

Furthermore, the yield spread between the U.S. two-year Treasury note (4.38%) and the U.S. ten-year government bond (3.83%) is negative 55 bp, less than the negative 80 bp differential in early December; however, the yield curve is still near its most inverted level since 1981. An inverted yield curve generally suggests investors are worried about the economy’s long-term prospects; they are lending their money out for the long term at rates well below short-term rates.

In summary, the mixed economic signals that various markets are sending out about the economy have made investment decisions difficult in 2022. Unfortunately, these decisions do not seem to be getting easier as the calendar turns to 2023.

Information for this briefing was found via Edgar, The St. Louis Federal Reserve, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.