On September 13th, Jushi Holdings (CSE: JUSH) announced that they completed their acquisition of Nature’s Remedy for a slightly reduced $91.2 in million total consideration, instead of the original $100 million agreed upon. The company reduced the number of shares issued to 8.7 million instead of the original 11.9 million, but increased the debt component to $16.50 million.

Nature’s Remedy has a 50,000 square foot cultivation and production facility, with a 22,000 square foot “high-quality” indoor production and “state-of-the-art extraction” facility. The company expects to expand that to 32,500 square feet by the end of this year. They also operate 2 retail dispensaries.

Jushi Holdings currently has 6 analysts covering the stock with an average 12-month price target of $12.14, or a 143% upside. Out of the 6 analysts, 2 have strong buy ratings and 4 have buy ratings. The street high sits at $14 from PI Financial and the lowest comes in at $10.

Canaccord Genuity reiterated their U$8/C$10 price target and Buy rating on the stock after the news dropped. Bobby Burleson, Canaccord’s analyst, says, “With the ability to walk away based on original deal terms, management was able to negotiate a lower price and receive roughly $20m in flower inventory to boot.” The price of the deal now sits at sub 2.5x 2022 EBITDA.

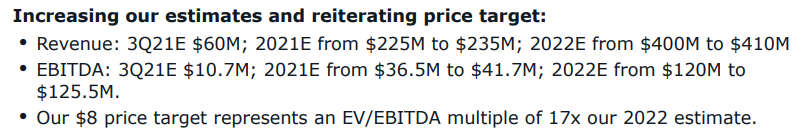

With the close, Canaccord has elected to raise their full year 2021 and 2022 estimates slightly but are keeping their third quarter estimate the same.

They add that the cultivation assets acquired come with additional room for expansion, with the operation producing 16,000 pounds of biomass and 9,000 pounds of high-quality cannabis annually currently. Jushi expects to bring this number up to 26,000 pounds and 13,000 pounds, respectively. The facility is located within a 185,000 square foot complex, “which presents numerous expansion opportunities and could potentially accommodate up to an additional 18,000 to 20,000 square feet of canopy.”

Canaccord calls the two dispensaries acquired strong retail locations in “strategic locations.” with one located along the “Worcester-Providence Turnpike and is in close proximity to the Shoppes at Blackstone Valley, Central Massachusetts’s largest open-air shopping center.” While the other location is located near the Pheasant Lane Mall, which is one of the largest malls in New Hampshire.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.