On August 25, Jushi Holdings Inc. (CSE: JUSH) reported its full Q2 results after pre-announcing revenues of $47.7 million, up 14.6% sequentially, on August 2. The company announced an adjusted EBITDA of $4.6 million or a 9.6% EBITDA margin.

Gross profit grew 9.2% to $21.9 million while net income swung to positive $4.8 million from ($26.8) million last quarter. The company also said they will be slightly lowering their full-year 2021 guidance from $205 – $255 million to $220 – $230 million in revenue and adjusted EBITDA to $32 – $27 million from $40 – $50 million prior.

Jushi Holdings has 7 analysts covering their stock, with the average 12-month price target coming in at $12.14, or a 105% upside. The street high sits at $14 from PI Financial and then the lowest comes in at $10.41. Out of the 7 analysts, 3 have strong buy ratings and the other 4 have buy ratings.

PI Financial in their note reiterated their buy rating and $14 price target on the stock saying that the results were very neutral and that the new guidance came in-between their current estimates.

PI Financial notes that Jushi saw a deceleration in top-line growth, down from the 29% sequential growth it saw for the last two quarters but they believe that growth will reaccelerate during the fourth quarter of 2021 as there are multiple store openings, expanded cultivation capacity, and M&A closing.

They continue to believe that Jushi is the market leader in the Pennsylvania market, as the company opened it’s 12th and 13th dispensary this quarter with them hoping to hit the 18 dispensary limit by the end of the year. The company is also on track to complete their Phase 1 expansion to their facility increasing the canopy to 45k sq ft and the total size of the facility to 130k sq ft.

PI Financial says that Virginia could be a strong catalyst in 2022 as the market has been slow to take off. They add, “the stores that JUSH are building will be very large and likely perform well above the average dispensary once the medical program accelerates.”

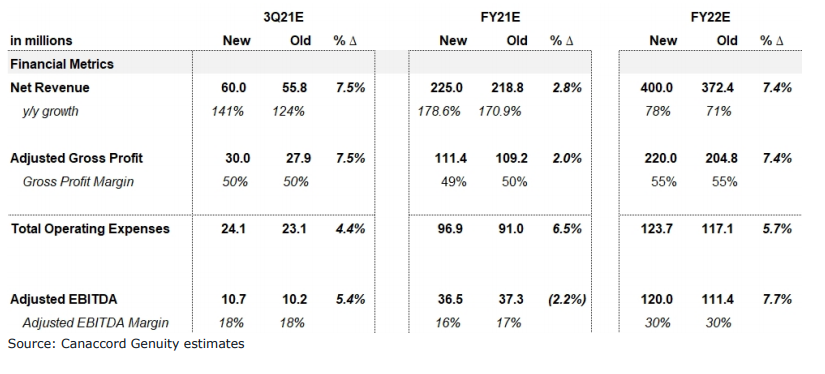

For Canaccord, they reiterated their U$8 price target and by rating, basically reiterating what PI Financial said around potential catalysts. Their views on the earnings are very similar but they elected to lower their third quarter, full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.