After two consecutive C$30 million raises, Jushi Holdings (CSE: JUSH) has received three new analyst initiations. First is PI Financial, whom initiated on Jushi yesterday morning with a 12-month price target of C$14/U$11 and a buy rating. Jason Zandberg, PI’s cannabis analyst headlines “Turn to this MSO for Juicy Returns” (Nice pun).

On the 11th, Canaccord Genuity initiated on the company with a U$7.50 price target and speculative buy rating. Bobby Burleson headlined, “Attractively valued MSO with differentiated market position and solid balance sheet.” Lastly, Cantor Fitzgerald initiated on Jushi January 7th with a U$6 price target and neutral rating. Pablo Zuanic headlines, “After a Good Run, Stock Likely to Take a Breather.”

Zandberg of PI Financial appears very bullish, saying Jushi should continue to be one of the top performers of the mid-tier MSO space and that the firm provides the best potential upside for investors. He adds, “we see Jushi as on the cusp of graduating to the large-cap space which will elevate its profile and trading valuation.”

Zandberg then says that it has a strong position in both Pennsylvania and Illinois as well as an enviable position in Virginia.

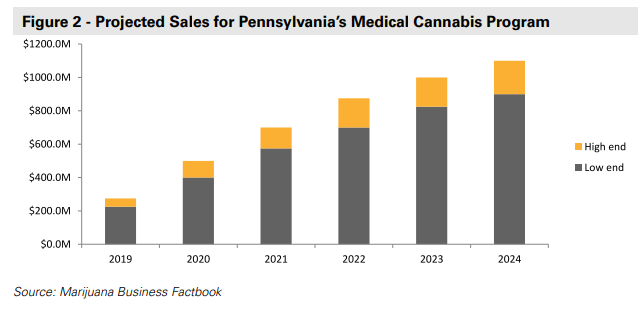

For Pennsylvania, Jushi currently operates eight dispensaries and can open seven more, equating to 12% of the available licenses in the state. Jushi also owns a cultivation and production facility within the state. This is notable as they have the second-highest supply/demand mismatch. Zandberg projects that the state’s medical market will be between U$600-U$750 million in 2021, going up to U$0.9-U$1.1 billion in 2024.

Onto Illinois, Jushi has three stores open, with a fourth coming online soon. Although Zandberg does not have a forecast for Illinois, their current run rate is roughly 1.2 billion.

In Virginia, Jushi holds one license covering roughly 30% of Virginia’s 8.7 million person population and is across the river from Washington, DC. Zandberg writes, “This region is the most densely populated region, has the highest income levels and has the lowest median age – all three characteristics that drive cannabis sales.”

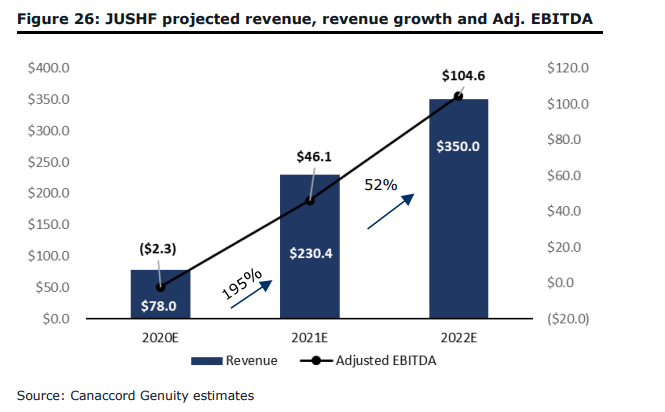

Bobby Burleson, Canaccord’s analyst, mostly has the same talking points as Zandberg, having highlighted the same three states. He says that store openings will be a major driver for revenue as Jushi looks to expand its store count from 13 to 23 by year-end.

On Pennsylvania and Illinois, Burleson says that together they makeup roughly 77% of their overall 2021 forecast and stay above 70% in their 2022 forecast.

For Virginia, he writes, “VA is a nascent medical market with limited product breadth and a highly restrictive licensing structure. We believe JUSHF’s permit to operate in the state’s most attractive zone from a population density and affluence standpoint bodes well for revenue potential and attractive profitability metrics.”

Below you can see Canaccord’s Revenue and EBITDA forecast for 2020 – 2022.

Pablo Zuanic from Cantor Fitzgerald meanwhile calls the company’s organic expansion plans to grow sales as much as 2.6x in 2021 ambitious. He also says that Jushi has made good use of the recent share price run by doing back to back share issuances.

He writes, “While we do not question the company’s valuation, we note that, under our benchmarking framework, Jushi does not screen among the top operators.” He says that their franchise strength isn’t as strong as people think as they only have depth in PA/VA, while over 90% of sales come from retail, with an above-average reliance on third party products.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.