On October 7th, K92 Mining Inc. (TSX: KNT) announced that the board of directors has approved the Stage 2A Expansion at its flagship mine, which will increase annual throughput by 25% to 500,000 tonnes per annum. The company says that the estimated cost of capital will be roughly US$2.5 million, and full commissioning will commence in the third quarter of 2022.

K92 Mining currently has 12 analysts covering the stock with an average 12-month price target of C$11.48, or an 80% upside. Out of the 12 analysts, 4 have strong buy ratings and 8 have buys. Stifel-GMP has the street high of C$14 while the lowest comes in at C$8.75.

BMO Capital Markets released a note outlining their thoughts on this news release, reiterating their C$11 price target and outperform rating on the stock, while saying Stage 2A “serves as an incremental step toward the full Stage 3.” They have adjusted their assumptions and forecasts as they expect Stage 2A to come online in the fourth quarter of this year.

On top of forecasting when Stage 2A will come online, they also revised their assumption for the ramp-up period of Stage 3. They write, “we believe Stage 2A will shorten the ramp-up timeline slightly,” and will be watching for the company to provide more details on the timeline of these expansions.

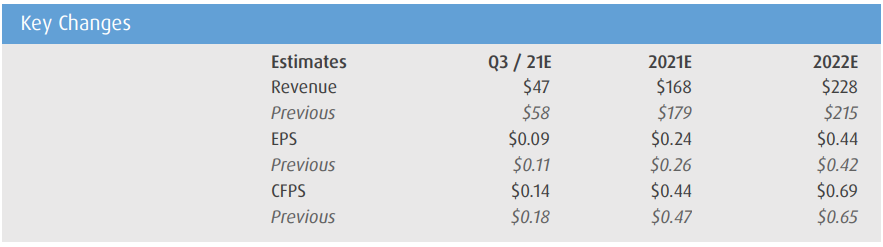

Below you can see BMO’s updated third-quarter estimates, as well as their full year 2021 and 2022 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.