K92 Mining Inc. (TSX: KNT) reported its second quarter production results last week. The company announced that it produced 22,934 ounces of gold, 1,229,961 pounds of copper, and 25,224 ounces of silver, equating to 26,085 gold equivalent ounces. The company reiterated its production guidance of 115,000 to 140,000 gold equivalent ounces for the full year 2022.

The company said that the mine reached a record plant throughput of 108,853 tonnes processed during the quarter or 1,196 tonnes per day, with a record daily mill tonnes processed achieved on June 29 of 1,559 tonnes and a record monthly average mill throughput achieved in June of 1,251 tpd.

K92 Mining currently has 13 analysts covering the stock with an average 12-month price target of C$12.10, or an upside of 70%. Out of the 13 analysts, 4 have strong buy ratings and the other 9 analysts have buy ratings on the stock. The street high price target sits at C$14 and represents an upside of 95%.

In BMO Capital Markets’ note on the production results, they reiterate their outperform rating and C$11 12-month price target on the stock, saying that the quarter was strong if you can look past the low grades milled.

On the production results, BMO says that K92’s results of 26,085 ounces came in way below their 31,000-ounce estimate, which was primarily attributed to lower grades. BMO estimated gold grades of 9.8 grams per tonne while the company reported grades of 7.2 grams per tonne, which is below the company’s typical 8.12 grams per tonne.

Though the result came in below BMO’s estimate, they say that operationally, the company looks strong, with throughput averaging 1,196 tpd for a total of 108,853 tonnes processed in the quarter, which was a new record for the Kainantu mine. They add, “Mining activities kept up with the process plant, churning out 114,471 tonnes of ore that also represents another record.”

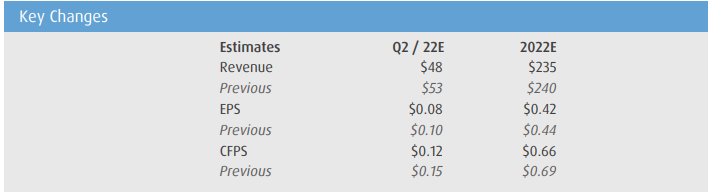

Lastly, BMO expects that K92 will show growth during the second half of 2022, saying, “The promising throughput performance at Kainantu sets the stage for production to grow in the second half of the year beyond H1 levels.” Though they have slightly trimmed their production estimates, going from 136,000 ounces to 131,900 ounces.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.