Yesterday morning Canaccord analyst Tom Gallo upgraded his twelve-month price target on K92 Mining (TSXV: KNT) to C$12.50 from C$8.75 while reiterating his Buy rating on the company. Gallo headlined the target change with “pounding the table on one of the best ore bodies we’ve ever seen.”

The price target increase comes after Canaccord added the exploration upside, and the second quarter resource update. Gallo says that he “envisioned a slightly different future operating scenario than is outlined in recently PEA.”

Canaccords model reflects 44,000 ounces with a full ramp-up to beyond Phase 3 numbers by 2025. Further, they modeled 1.3 million tonnes per annum of processing, versus the preliminary economic assessment figure of 1.0 million tonnes per annum, which is mainly due to the 400 kilotonne per annum plant. The plant is currently in use but management believes that it will sit idle going forward. Gallo comments on this, saying, “We do not think this is likely and believe the ore body and ongoing twin incline will support increased throughput.”

Gallo has forecasted for a life of mine operating cash cost of $389 per ounce and an all-in sustaining cost of $517 per ounce, versus the PEA of $202 per ounce and $362 per ounce, respectively. Gallo reflects on this, stating it is a, “key area for further upside to our target.”

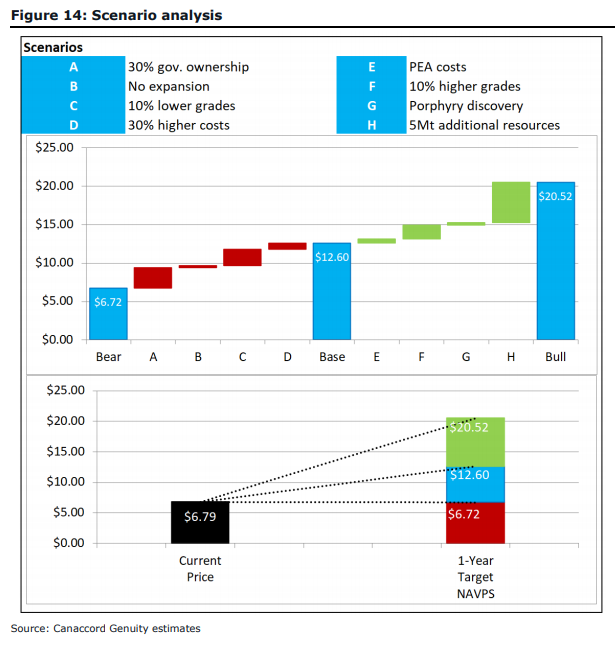

Below you will find a scenario analysis that models a potential upside of $20.52 and a downside of $6.72. Gallo adds that this “shows a risk

profile skewed to the upside supportive of our BUY rating and Top Pick status.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.