On July 28, Kinross Gold Corporation (TSX: K) reported their second quarter results. The company announced that they produced 538,091 ounces of gold in the second quarter with an all-in sustaining cost of $1,069. This means they produced almost 1.1 million ounces of gold in the first half of the year. The company also revised its 2021 guidance, they now expect 2.1 million ounces of gold to be produced with an all-in sustaining cost or $1,110. The company reported second quarter revenues of $1 billion, flat year over year, while gross profits decreased 14.4% year over year to $315 million.

Analyst’s expectations seem unchanged from before the results with their average 12-month price target only decreasing by $0.03 to $13.02. The street high sits at $17.50 while the lowest is $9. Out of the 13 analysts covering the stock, 3 have strong buy ratings, 9 have buy ratings and 1 analyst has a hold rating.

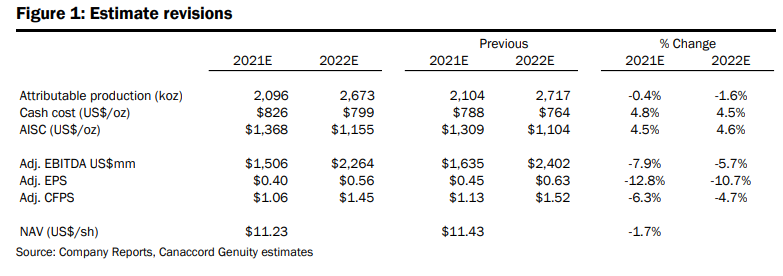

Canaccord Genuity lowered their 12-month price target on Kinross to $12.50 from $13.50 and reiterated their buy rating. The lowering was due to higher expected operating costs, but the firm calls 2022 a bright year with Tasiast restarting in the fourth quarter.

For the second quarter, the results came in slightly weaker than Canaccord was expecting, which is partly due to lower production and higher costs. This trend will continue until 2022 as the company increased its cost guidance, with cash costs up 5% and all-in sustaining costs up 8%.

Canaccord says that the balance sheet continues to improve, with Kinross ending the quarter with $676 million after paying off $500 million in maturing notes. The company is also doing a share buyback, which allows them to repurchase up to 5% of their shares over the next 12 months, equalling up to $400 million in costs if fulfilled.

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.