This week Kinross Gold (TSX: K) announced that they would be issuing their first dividend since 2013. They announced a dividend of U$0.03 and guided till 2023. The company said that production is expected to rise 20% to 2.9 million gold ounces in 2023 while slowly lowering the cost of sales and capital expenditures to drive a strong and robust free cash flow.

Several analysts have recently updated their price targets and ratings as a result:

- Eight Capital raises price target to C$15 from C$14

- CIBC raises target price to $14 from $13

- BMO raises to outperform from market perform

- BMO raises price target to $14.25 from $13.50

- Scotiabank raises target price to $11 from $9.50

Jackie Przybylowski of BMO commented, “Upgrading to Outperform: Kinross Drops a Big Update Ahead of Denver” in his note. He upgraded both the rating and the 12-month price target on Kinross Gold to an Outperform and a C$14.25 price target.

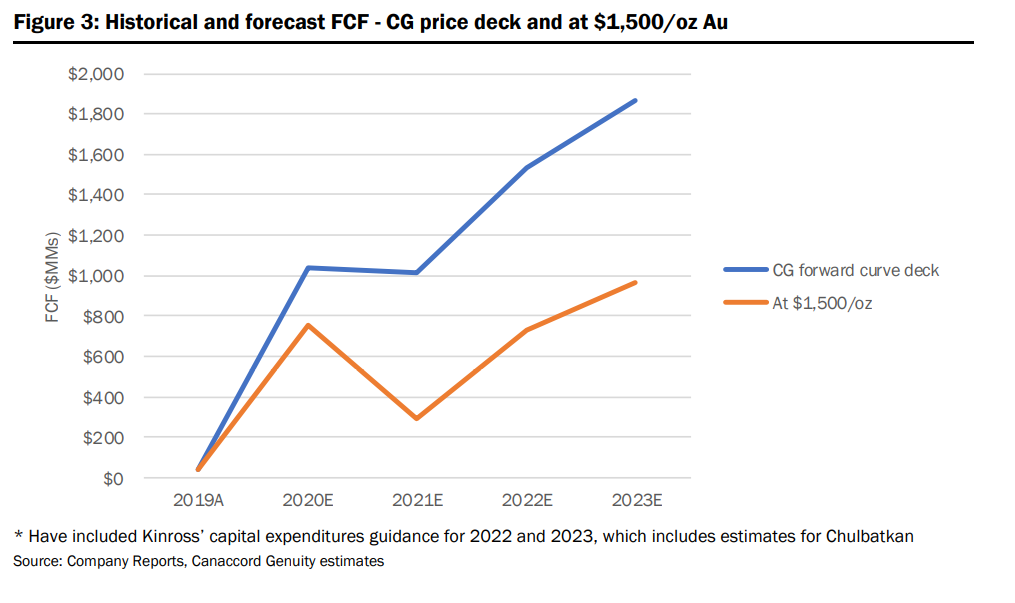

On the other hand, Carey MacRury from Canaccord Genuity said, “three-year guidance points to strong FCF profile; dividend re-initiate,d” while reiterating their Buy rating and their C$16.50 price target on the stock.

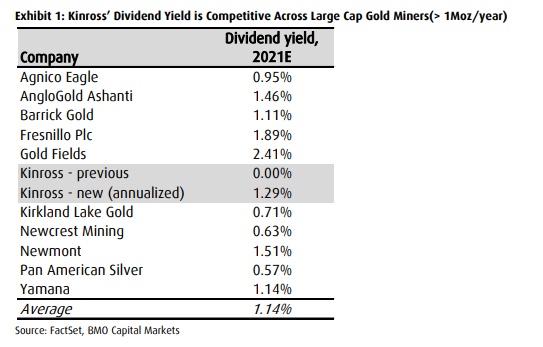

In BMO’s note, Przybylowski says that “Kinross is demonstrating its discipline by maintaining a conservative gold price assumption,” and by restating their dividend at a competitive 1.3% yield, which is high relative to its peers. She says with Kinross maintaining a conservative gold price assumption it shows that they are disciplined as higher gold prices have supported what she calls “bad behavior” and is a crucial concern for investors during COVID-19. Kinross will continue to use a US$1,200/oz gold price assumption, which BMO views as a significant positive.

She then says, “production decline in 2024E […] can be mitigated with organic growth.” This is based on the $330 million Chulbatkan projects not being modeled into their production estimates just yet, which means with organic growth, they can recover the decline in production for 2024E

Przybylowski update’s her estimates on Kinross based on “management’s ability to balance a disciplined and conservative approach with reinvestment in value-accretive projects.” They now estimate 2020 and 2021 revenue to come in at $4.4 billion and $5 billion, respectively.

Onto Cannacord’s note, Carey MacRury states, “our key takeaway from the guidance update is the confirmation of a strong FCF profile,” and, “with an improving FCF profile, strong execution, and one of the most inexpensive senior producers at 0.7x NAV vs. senior peer average of 1.0x Kinross remains a top pick.”

Canaccord forecasts Kinross to achieve a net cash position of roughly $270 million in 2021 from a net debt position of $1.2 billion at the end of 2019 and to repay the $500 million note maturing in 2021 fully. Canaccord has also changed their full-year 2021 production estimate while keeping their 2020 estimate of $2.38 billion the same. They now expect 2021 production to come in at $2.41 billion.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.