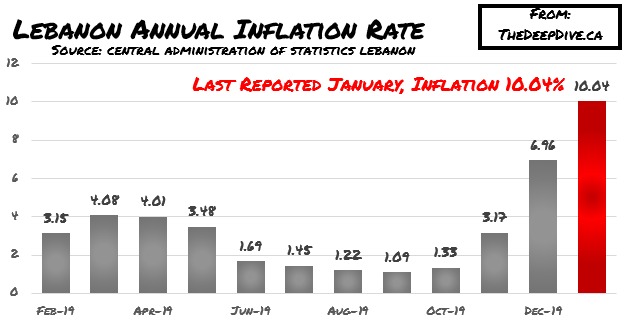

A recent alarming development in Lebanon has really put into focus some of the dire situations the coronavirus has been leaving behind in its path of destruction. In just a short while, a bout of hyperinflation has cut the value of the Lebanese pound in half, sparking mass riots in the capital city of Tripoli.

The Lebanese economy has already been the subject of a financial crisis since October, with soaring unemployment and inflation which has further deteriorated since the country went into a shutdown as a means to slowing the coronavirus spread. The growing economic consequences have been too much for many citizens to bare, giving rise to angry protests which have now been met with soldiers, rubber bullets, and tear gas.

In retaliation, rioters have set ablaze army vehicles, in addition to setting fire to several banks, which in turn caused the city to shut down all remaining banks until additional security can be established. Apparently, Lebanese banks have been targets for rioters since the economic collapse in October, with many using it as a form of frustration venting against the freezing of people’s savings accounts.

Banks set on fire in #Lebanon as currency crashes in hyperinflation event. pic.twitter.com/B46royW8vY

— Ministry of Truth (@BanTheBBC) April 28, 2020

Looking increasingly bad in #lebanon This is Tripoli… pic.twitter.com/Tk1UTHWuyL

— sebastian usher (@sebusher) April 28, 2020

Thus far, a young man has been shot dead as a result of the protests, and two soldiers have been mildly injured. Soldiers have been busy dispersing crowds, but an end to the frustration is most likely not in near sight.

Information for this briefing was found via RT News and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.