It appears billionaire hedge fund investor Leon Cooperman is losing faith in Green Thumb Industries Inc. (CSE: GTII) founder and CEO Ben Kovler — the same Ben Kovler who got Cooperman into pot stocks in the first place, all the way back in 2018.

At the Q1 2022 earnings call on Wednesday, Cooperman grilled Kovler over the frequency of insider selling and the glaring lack of insider buying at Green Thumb.

“Are you fully invested in the company? You have all the right buzz words, but I don’t see the action. I see insider selling; I don’t see insider buying,” the investor reiterated. “I know the company’s not going to buy, but what’s going to make the management buy?”

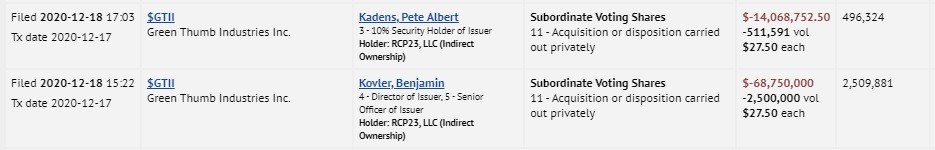

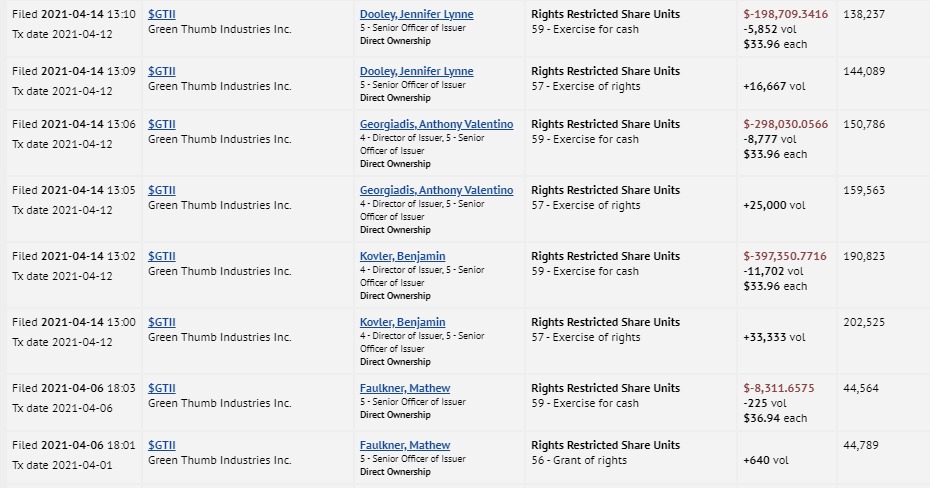

Cooperman was likely referring to the at least eight instances of insider selling amounting to a total of $68.8million in 2020 and US$53.5 million in 2021.

Kovler was adamant in his response, claiming that there’s “no real insider selling.”

“Sometimes there’s filings because you get equity, there’s tax trigger and things like that for the rules, but you do not see any swaps that insider selling at all,” he said, and gave not much else after as direct response to Cooperman’s main concern.

Cooperman persisted, telling the Green Thumb founder to look at Bloomberg and see.

“What I see is nothing but insider selling for three pages. I don’t see any insider buying whatsoever. I see options, surrenders, and I see outright sales. You know what I’m talking about. I think you got all the buzz words, but–,” he said before Kovler cut him off.

“We’re clearing that up, but that’s fine, Lee. I hear you. That’s good,” Kovler acknowledged before redirecting the conversation toward how “influencers in New York, like yourself who have a voice with the New York Stock Exchange in the NASDAQ, will not let us be listed.”

One key detail that was not mentioned is how Kovler’s Green Thumb holdings have dramatically decreased from 2,771,502 in 2020 to 592,969 in 2021.

Kovler on Thursday tweeted a follow-up to his non-explanation and reported that he is still Green Thumb’s largest shareholder.

Just breathe ♾

— Ben Kovler (@Bkov9) May 5, 2022

Carpe Diem. Fun time yesterday.🔥

PS. No recent insider selling. Lee was looking at "sell to cover" which is triggered w equity compensation. We believe in equity comp & aligned incentives. 🇺🇸

I remain the largest shareholder in The Thumb 👍 $GTBIF $MSOS 🪴 pic.twitter.com/KoPoQkCEz2

So yeah, carpe diem?

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.