Li-Cycle (NYSE: LICY) recently reported its third-quarter financial results. The company reported revenues of -$2 million; this was due to an “unfavorable non-cash fair market value (FMV) pricing adjustment of $(7.3) million relating to prior-period black mass sales.” This made the company’s product sale segment come in at -$2.34 million, and recycling service revenues came in at $0.373 million.

Operating expenses for the quarter were $32.5 million, of this, share-based compensation was $4 million, and salaries and benefits came in at $9.5 million. Professional fees came in at $4.2 million. This brought the company’s net income to -$27.5 million, or earnings per share of -$0.16.

The company ended the quarter with $649 million of cash on hand and about $285 million in long-term convertible debt. The company said that it continues to evaluate multiple capital sources, such as debt and funding from potential strategic partners.

Li-Cycle currently has eight analysts covering the stock with an average 12-month price target of US$10.13, or an upside of 61%. Out of the eight analysts, two have strong buy ratings, four have buy ratings and the last two analysts have hold ratings. The street high price target sits at US$13 and represents an upside of 107%.

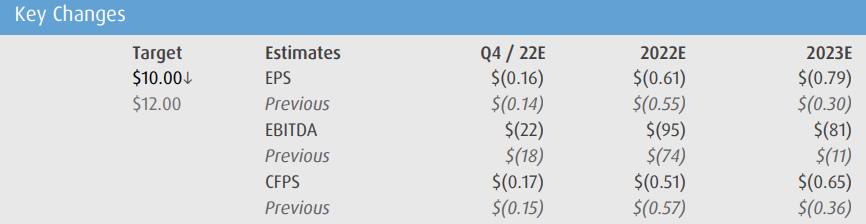

In BMO Capital Markets’ note on the results, they reiterated their outperform rating but cut their 12-month price target to $10 from $12, saying that they acknowledge that the stock could trade sideways until the Rochester Hub-plant completion which is expected to be around the end of 2023, and expects there to be more growing pains ahead.

Even with that, BMO writes, “Li-Cycle is still a well-capitalized first-mover as a Western battery recycler; is well positioned to benefit from various government led OpEx/funding assistance programs to be deployed over the near-term; and is backstopped by further moat support given its Tier-1 partners.”

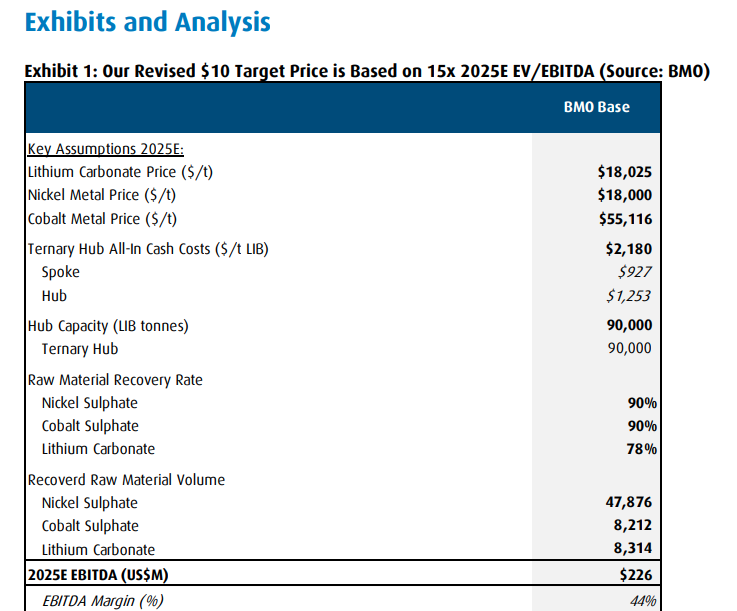

As a result of the earnings, BMO has reset its expectations on earnings going forward. They now expect EBITDA to be $225 million in 2025 with an EBITDA margin of 44%. Additionally, with the Rochester Hub expected to be done by late 2023, they expect a company de-risking to happen during 2024.

As a result of this, BMO now expects that the Hub-2 start-up will happen roughly 2 to 3 years after the Richester Hub is completed. Additionally, they expect Li-Cycle to get a 10% OpEx subsidy to their US recycling plants. Subsidies will primarily be for processing costs and not battery metal feedstock.

Below you can see BMO Capital Markets’ updated estimates on Li-Cycle.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.