Liberty Gold (TSX: LGD) is set to spin out one of its assets into a new entity following another discovery. The company intends to spin out its Goldstrike Project in southwestern Utah into a new US-focused strategic metals company.

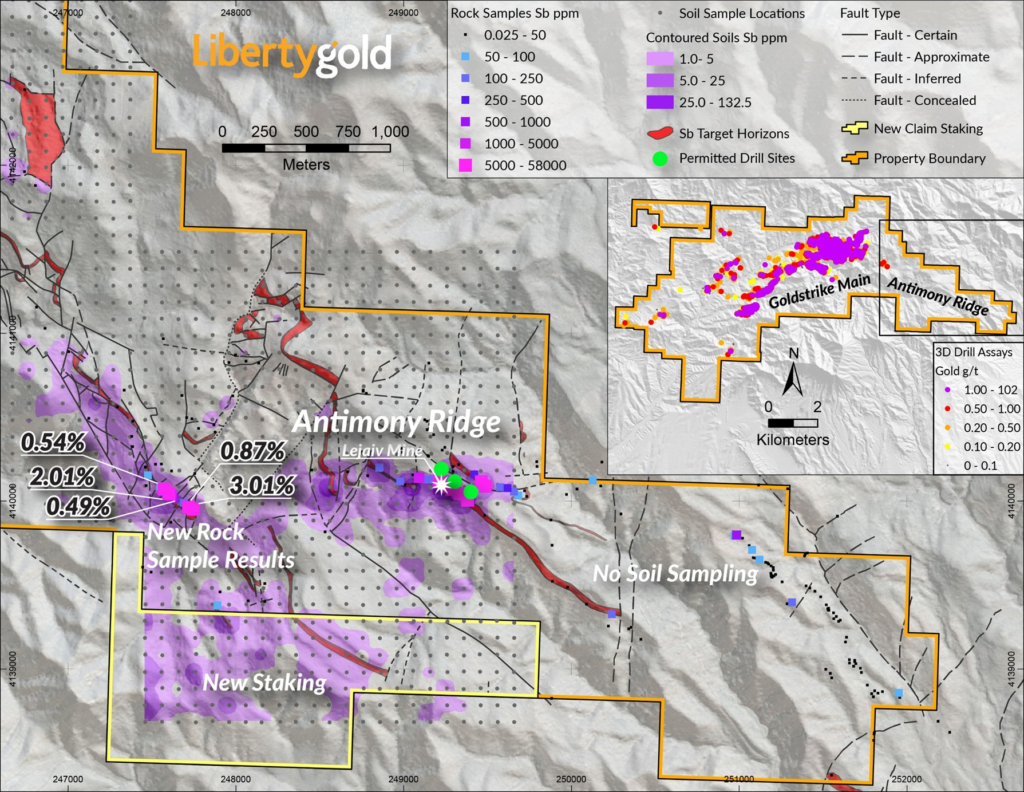

The decision to spin out Goldstrike follows the company identifying a third zone of high grade antimony mineralization at the Antimony Ridge discovery. The new zone is said to be 400 metres long, 1.5 kilometres to the west of previously identified mineralization, where high grade antimony oxide mineralization is present.

Antimony mineralization is said to have now been mapped over a strike length of more than 2.0 kilometres, with antimony values in soils suggesting up to 3.0 kilometres of further strike length exists on site. Surface samples have demonstrated up to 3% antimony and up to 0.68 g/t gold. Preliminary metallurgy work meanwhile suggests recovery rates of between 51% and 76% are possible for the antimony, resulting a concentrate grading between 45% to 50% antimony.

Two square kilometres of further claims have been staked near the southern soil anomalies, resulting in a claim block area of 10 square kilometres, which contains no royalties. The company meanwhile has permits in hand to drill test three sites near the historic Lejaiv antimony mine on site.

Moving forward, Liberty Gold will remain focused on its Black Pine Oxide Gold Project in Idaho, while the spinout will focus on the development of Antimony Ridge at the Goldstrike Project.

“Antimony Ridge is an exciting, emerging story that is demanding more attention with every high-grade assay coming out of the lab. We believe that separating Liberty Gold into two independent entities will unlock significant shareholder value and maximize market exposure to both the Black Pine Oxide Gold Project in Idaho and to the new Antimony Ridge discovery at our Goldstrike Project in Utah. Terms of the spin-out concept are being finalized now,” commented Cal Everett, CEO of Liberty Gold.

As part of the next steps, Liberty Gold will form a new entity for the purposes of spinning out Goldstrike, with full details of the arrangement to be released at a later date. In the interim, surface sampling and field mapping are to occur on site, while Liberty has submitted a notice of intent for a 16-hole drill program that will test up to 5,000 metres in aggregate. Initial studies are also occurring to determine suitable processing facilities.

Liberty Gold last traded at $0.38 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.