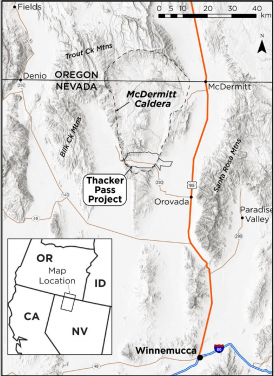

As an illustration of the difficulty of building sufficient lithium production to satisfy battery needs of the booming electric vehicle (EV) industry, Lithium Americas Corp. (TSX: LAC) is facing resistance and delays in the construction of its Thacker Pass battery-grade lithium carbonate project in the U.S. state of Nevada.

Specifically, on June 8, the U.S. Bureau of Land Management (BLM) and Lithium Americas agreed to a court-enforceable stipulation that Thacker Pass construction cannot begin until July 29 at the earliest.

Thacker Pass Timeline

On January 15, 2021, the BLM issued a Record of Decision approving Lithium Americas’ 100%-owned Thacker Pass project. Thacker Pass may produce 60,000 tonnes of battery-grade lithium carbonate per year for 46 years. Since each tonne of lithium carbonate produces enough lithium metal to make 15 lithium-ion EV batteries, Thacker Pass’s future output would be sufficient to build the powerhouses of roughly 750,000 EVs per year. Phase 1 construction costs are projected to be US$581 million.

On February 26, conservation groups filed a federal lawsuit in the District of Nevada saying the BLM’s decision could threaten the sage grouse and other wildlife. Still, mine construction was set to begin on June 23, so the groups requested a preliminary injunction to prohibit construction in U.S. Federal District Court in Reno, Nevada on May 27.

Chief Judge Miranda Du is overseeing the case in federal court in Reno, and she has in the past ruled in favor of preserving sage grouse habitats. The judge’s previous stances likely played a role in the BLM/Lithium Americas June 8 decision to delay construction until at least late July. If Judge Du were to grant the injunction request filed on May 27, the company may not be able to develop Thacker Pass until she determines whether the BLM was justified in its January 15 Thacker Pass approval decision. The timing of her decision on the injunction request is unknown.

Lithium Americas’ Cauchari-Olaroz Project

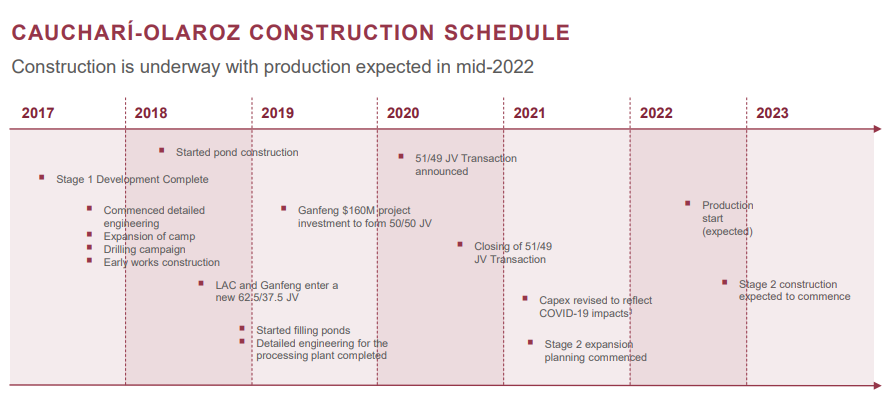

Lithium Americas owns 49% of the Cauchari-Olaroz lithium brine project in Argentina. China’s largest lithium company, Ganfeng Lithium, owns the balance. The Argentine facility is expected to be finished by mid-2022 and is forecast to produce 40,000 tonnes of battery-grade lithium carbonate annually for 40 years. Construction is currently about two-thirds complete. Offtake agreements are in place for 90%+ of production.

(In early March 2021, Lithium America announced a six-month delay in the expected start date of production at Cauchari-Olaroz. Since October 2020, the company had projected construction to be complete by the end of 2021, and for production to commence in early 2022.)

Total construction costs should be around US$641 million. According to a September 2019 Definitive Feasibility Study, Cauchari-Olaroz could produce average EBITDA of more than US$300 million per year.

Large January 2021 Equity Offering Bolsters Balance Sheet

In January 2021, Lithium Americas raised around US$400 million by selling 18.2 million shares of common stock at US$22 per share in an underwritten public offering. Proceeds from the sale boosted the company’s cash balance to more than US$500 million as of March 31, 2021.

Lithium Americas’ operating cash flow deficit has averaged about US$8.5 million per quarter over the last four reported quarters, but that is relatively modest in relation to its cash position. Cash flow should turn positive in mid-2022 as the Cauchari-Olaroz project begins commercial production.

| (in thousands of US $, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($8,759) | ($8,065) | ($5,743) | ($6,494) | ($10,312) |

| Operating Cash Flow | ($11,416) | ($7,108) | ($7,204) | ($8,355) | ($8,214) |

| Cash – Period End | $514,205 | $148,070 | $71,888 | $49,719 | $82,122 |

| Debt – Period End | $134,961 | $121,221 | $122,294 | $151,371 | $150,076 |

| Shares Outstanding (Millions) | 119.9 | 101.1 | 91.4 | 90.6 | 90.0 |

It is possible that EV makers could eventually decide that traditional nickel-manganese-cobalt batteries are preferable to those with a heavy lithium content and no cobalt or nickel (even though cobalt production is decidedly unfriendly to the environment). In that case, a lithium miner like Lithium Americas would be disadvantaged.

The court action in Nevada is at the same time a negative and a positive for Lithium Americas. On the one hand, lithium production at its Thacker Pass facility will be delayed for some period. On the other hand, the situation in Nevada illustrates the difficulty of bringing a lithium mine ultimately to production. Since Cauchari-Olaroz in Argentina is now only about a year away from production, that mine must be considered even more valuable.

Lithium Americas Corp. last traded at C$16.73 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.