On February 16, QuantumScape Corporation (NYSE: QS), a U.S. technology company, announced an important advancement in the development of a solid-state, or lithium metal, battery for electric vehicles (EVs) – the manufacturing of a four-layer lithium metal battery cell. This is a necessary precursor to the eventual ability to produce multi-layered battery cells that would be commercially saleable and could disrupt the EV battery industry.

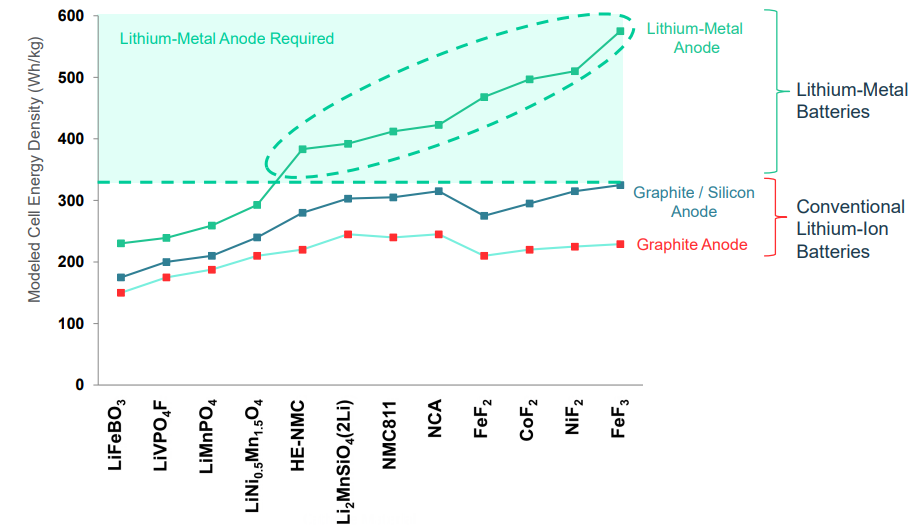

In turn, such technology would likely create substantial incremental lithium demand and be a significant positive for lithium junior miners such as Lithium Americas Corp. (TSX: LAC) and Sigma Lithium Resources Corporation (TSXV: SGMA). A working lithium metal battery would be a significant upgrade to a lithium-ion battery. It would be much more energy dense and could theoretically charge much more quickly, perhaps in as little as 15 minutes, and maintain its capabilities with little degradation for a long period (equivalent to hundreds of thousands of vehicle-miles). Furthermore, it would likely contain little nickel, cobalt or manganese.

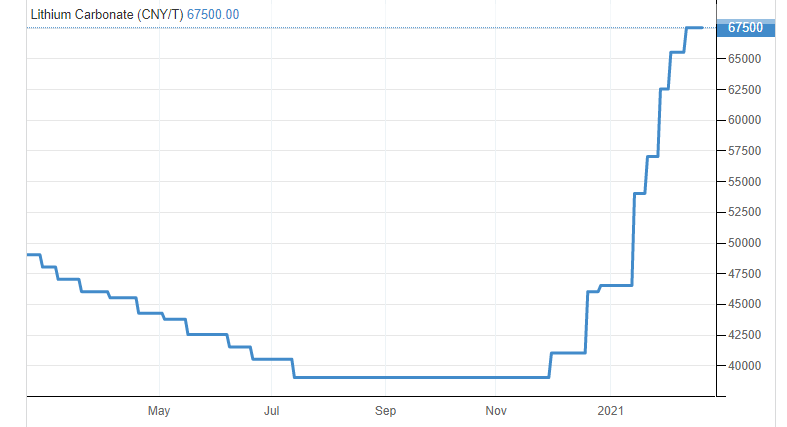

After a lackluster performance in 2020, and perhaps reflecting substantial future demand for lithium metal or conventional lithium-ion EV batteries, the price of lithium has exploded in 2021. The trading price of the lightest known metal has increased around 45% in about 1 ½ months.

Operating Differences Between Lithium-Ion and Lithium Metal Batteries

A typical lithium-ion battery is cylindrical in shape. It has an anode which is typically made from graphite on one side, and a cathode on the other. The graphite’s chemical makeup allows the anode to easily store lithium ions. A conductive liquid electrolyte separates the anode and the cathode. When the battery is charged, lithium ions move from the anode to the cathode where they are discharged.

QuantumScape’s lithium metal battery cell design has only two layers: a cathode and a very thin solid-state ceramic separator. No manufactured anode is present. The anode is comprised of lithium itself. Every electron then can be stored at the anode. This difference in anode composition is the key reason a lithium metal battery could have better energy density, be smaller in size, and lighter than a lithium-ion battery. In more detail, as the battery charges, lithium leaves the cathode, passes through a ceramic separator and deposits between the separator and an electrical contact on the end of the battery, where it forms an anode of metallic lithium.

QuantumScape is backed by Volkswagen, which has invested nearly US$400 million in the company and plans to use these batteries in future EVs. In total, QuantumScape has more than US$1 billion of cash, as it works toward commercialization. It plans to continue substantial R&D spending to push the lithium metal battery concept forward.

Risks Entailed in QuantumScape’s Design Concept

Of course, QuantumScape may not be able to produce this battery at scale. Also, the company has not released the type of ceramic material it uses as a solid-state separator. The material’s features are important, as the flow of lithium ions can in some cases act like a needle and puncture the separator, short-circuiting the battery.

A lithium metal battery is not yet commercially available, nor will it be for some period. However, QuantumScape is well capitalized and has substantial resources. News of a time frame for commercialization could have an impact on the shares of lithium miners like Lithium Americas and Sigma Lithium Resources, among other lithium-focused operators.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.