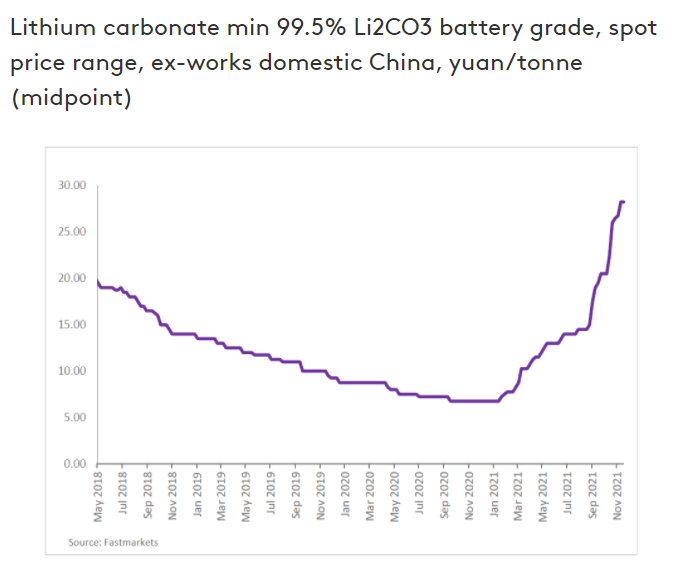

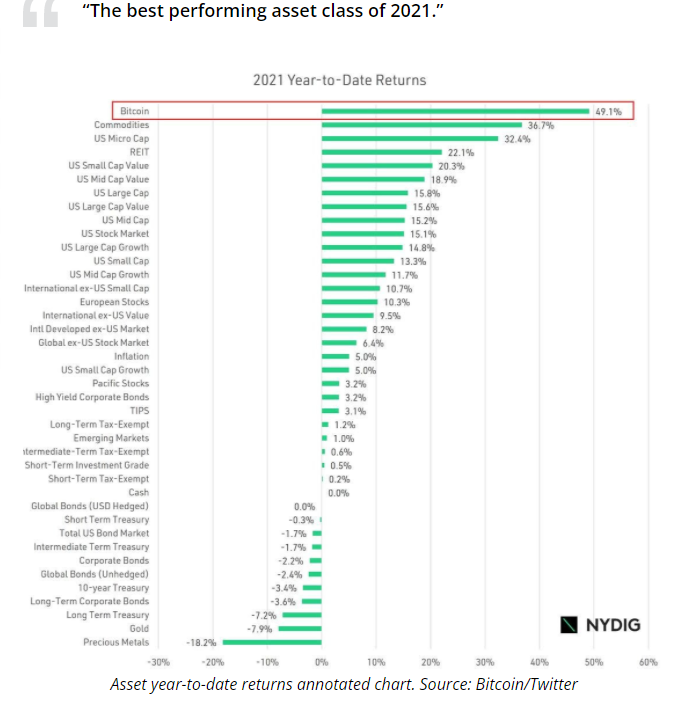

Lithium, a key component of the cathode in most electric vehicle (EV) batteries, is not only perhaps the best performing commodity in 2021, but also among the best performing assets of any type this year. Battery grade lithium carbonate prices have approximately quadrupled since December 31, 2020, and the pace of the increase has accelerated over the past few months.

According to China Central Television, this increase in lithium carbonate pricing has increased the cost to produce a battery-powered vehicle by nearly US$500. By comparison, through early October, Bitcoin, with a 49% return, was the broad asset class with the greatest year-to-date appreciation.

A passage in Fastmarkets, a publication which chronicles prices and supply-demand characteristics of many commodities, discussing the status of the lithium market in late November is telling: “A Chinese distributor active in southern Europe that sources lithium technical-grade carbonate said that producers he dealt with preferred to discuss short-term supply contracts rather than committing to long-term contracts on expectations that prices will continue to rise.”

The supply-demand lithium situation has prompted many lithium producers and EV manufacturers, particularly China-based companies, to secure future lithium production capacity. This is the case despite China’s possessing the fourth largest lithium reserves in the world (primarily in its remote Tibet and Qinghai provinces). Indeed, China imports about 70% of its lithium from foreign producers. As U.S.-based EV OEMs ramp up production, they will have to source all lithium from overseas producers as no lithium mines are currently operational in America.

Over the last few months, Ganfeng Lithium, one of the world’s leading lithium producers, and battery maker Contemporary Amperex Technology Co., Limited (CATL), China’s second largest company by stock market value, attempted to acquire Millennial Lithium Corp. (TSXV: ML). Millennial Lithium owns a lithium brine development project in Argentina. Another lithium company, Lithium Americas Corp. (TSX: LAC) ultimately outbid both Chinese companies for Millennial.

In September, Ganfeng bought the 9% stake it did not own in another lithium brine project in Argentina called the Mariana project. Mariana is less than 140 kilometers south of Atacama Salar in Chile, the largest producing lithium brine deposit in the world.

In October, Zijin Mining Group, a China-based gold, copper and zinc producer, decided to enter the lithium mining business when it reached a deal to buy Neo Lithium Corp. (TSXV: NLC) for around US$750 million in cash. Neo’s lithium brine project in Catamarca, Argentina is one of the highest-grade projects of its kind.

In early November, Do-Fluoride New Materials of China agreed to supply lithium hexafluophosphate (LiPF6) to BYD, a China-based EV OEM, for four years beginning in January 2022. The supply price was not disclosed.

Finally, on November 29, Stellantis NV (NYSE: STLA), the parent of Fiat Chrysler and Peugeot, signed a five-year agreement starting in 2026 with Germany-based Vulcan Energy Resources Ltd. Vulcan, which plans to utilize clean geothermal energy to produce battery-quality lithium hydroxide, will supply 81,000 to 99,000 tonnes of that material to Stellantis. The accord is predicated on the future successful start of production at Vulcan and full product qualification.

As an aside, even Albemarle Corp. (NYSE: ALB; market cap of US$31 billion), the world’s largest lithium miner, does not rule out acquiring smaller lithium producers, according to Eric Norris, its head of lithium, in an early November interview with Yahoo Finance.

Investors may want to consider two smaller lithium developers, Lithium Americas Corp. and Sigma Lithium Corporation (NASDAQ: SGMA). The flagship lithium properties for both companies, located in Argentina and Brazil, respectively, are expected to commence production in 2022.

And this is just the start. With the price of lithium expected to continue to rise, more transaction of this nature are surely to arise as global producers look to secure their supply chains in an increasingly electrified world.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.