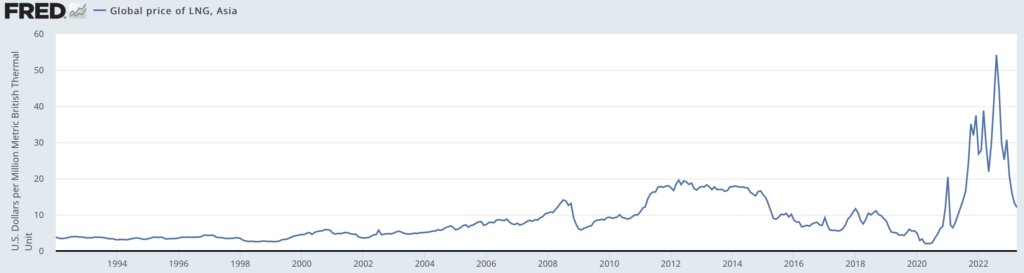

Predicting (or even attempting to understand) liquefied natural gas (LNG) price movements ranks among the most difficult tasks in the energy industry. On the one hand, spot prices of LNG have plummeted about 80% over the last nine months, the sharpest decline in history, as worldwide LNG demand is expected to fall off in 2024 after increases in 2022 and 2023, according to the Institute for Energy Economics and Financial Analysis (IEEFA).

European countries, particularly Germany, turned to LNG imports from the U.S. and Qatar to fill the gap from Russia’s 2022 decision to dramatically curtail natural gas shipments to Europe via pipelines. More specifically, U.S. LNG exports to Europe soared to an average of about 7.2 billion cubic feet per day (Bcf/d) in 2022 from around 3.2 Bcf/d in 2021. Similarly, exports from Qatar grew 23% and, remarkably, exports from Russia increased 12%.

Surprisingly effective European energy conservation efforts, generally temperate winter weather conditions, and more renewable power generation capacity additions have caused global LNG inventories to build to record highs, which in turn accounts for the projected reversal in 2024 demand growth.

On the other hand, Asian buyers are extremely interested in securing long-term LNG supplies. According to Wood Mackenzie, long-term deals for 13 million tonnes of LNG have been signed so far this year with Asian entities at improving prices — even as spot prices have plunged.

For example, China Gas Holdings reached a 20-year deal in 2023 to buy two million tonnes of LNG from Venture Global beginning in 2027. In addition, Wood Mackenzie notes that just in the past few months, such diverse Asian purchasers as Japanese utilities, oil supermajors (which will presumably re-sell the LNG to conventional buyers), another Chinese company, and a Turkish firm all signed long-term LNG accords with Oman.

READ: NET Power Looks To Change Trend Of Failing SPACs With Novel Power Tech

Furthermore, Bloomberg reports that Indian buyers are seeking long-term LNG supply deals. It appears these Indian companies are in discussions with Middle East producers.

Contrary to what spot prices would imply, pricing on these deals has gotten markedly richer. Wood Mackenzie notes that long-term LNG deals signed in 2020 and 2021 were typically set at 10% of the Brent crude price per one million BTUs. That percentage has reportedly risen to 12.5%, and some deals have been signed based on 17% of the benchmark price.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.