FULL DISCLOSURE: This is sponsored content for LNG Energy Group.

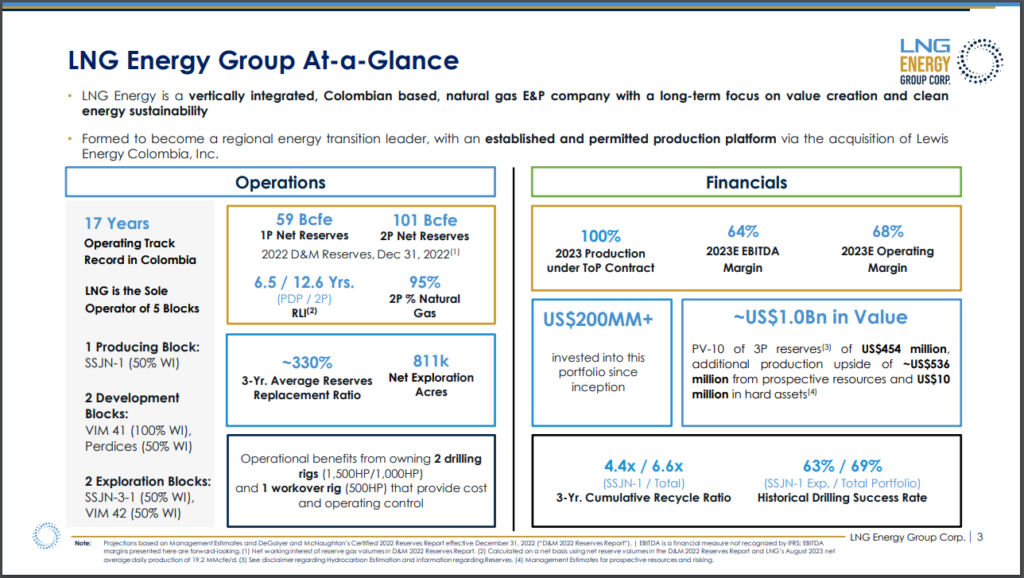

LNG Energy Group (TSXV: LNGE) has secured further non-dilutive capital as it works to build out its operations in Colombia.

The company has secured US$13.3 million under a letter of credit facility entered into with Macquarie Group. Funding from the credit facility is slated to be used to fund work commitment guarantees for its exploration and development blocks located in Colombia.

“This LC Facility frees up significant balance sheet capital that will be put to work in our drilling campaign and marks the latest milestone in LNG Energy Group’s evolution. The LC Facility is an important financial tool for us to be able to secure our acreage position on a non-dilutive basis,” commented LNG Energy CEO Pablo Navarro.

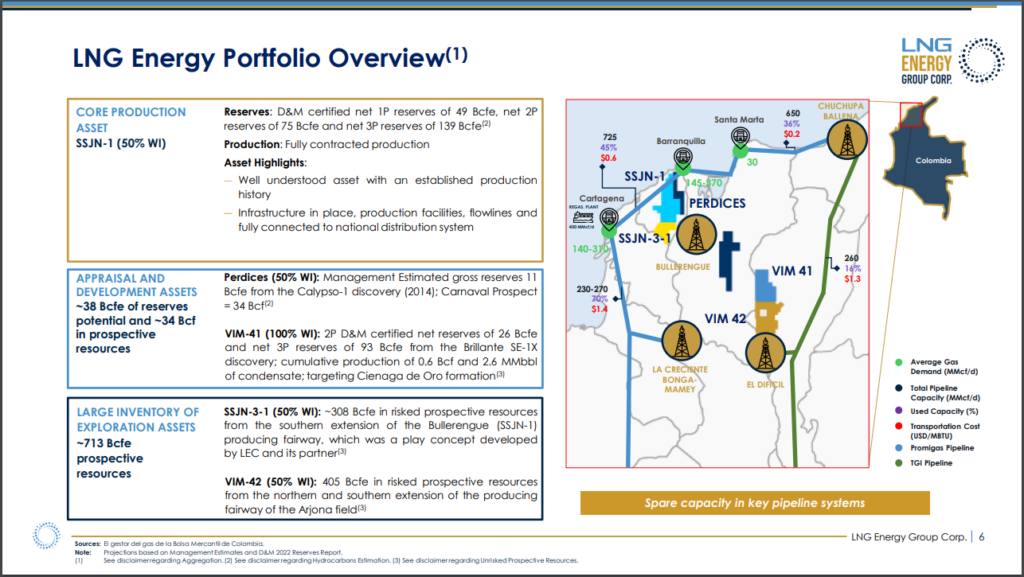

LNG Energy is currently embarking on a drilling and workover campaign at its SSJN-1 and Perdices blocks. The program is slated to include a minimum of three wells, the first of which will be the Bullerengue Oeste 5, or BO5, well at SSJN-1. It’s worth highlighting that LNG Energy owns both the drilling rigs, as well as the workover rig that will be utilized for the campaign, providing cost and operating control to the company.

SSJN-1 is referred to as LNG’s core production asset, which it has a 50% working interest in. Production is fully contracted at the block, with the asset boasting 19.2 million cubic feet equivalent per day of net natural gas sales in the month of August. Year to date the block has generated 18.6 MMcfe/d of average production, which is said to represent growth of 15% on a year over year basis.

While pricing was not provided for these sales, LNG has disclosed that beginning in December its natural gas sales will be realized at a range between US$8.30 and US$.80 per Mcf, based on new take or pay natural gas contracts. Those contracts are said to have a duration of four to five years.

LNG Energy Group last traded at $0.25 on the TSX Venture.

FULL DISCLOSURE: LNG Energy Group is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of LNG Energy Group. The author has been compensated to cover LNG Energy Group on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.