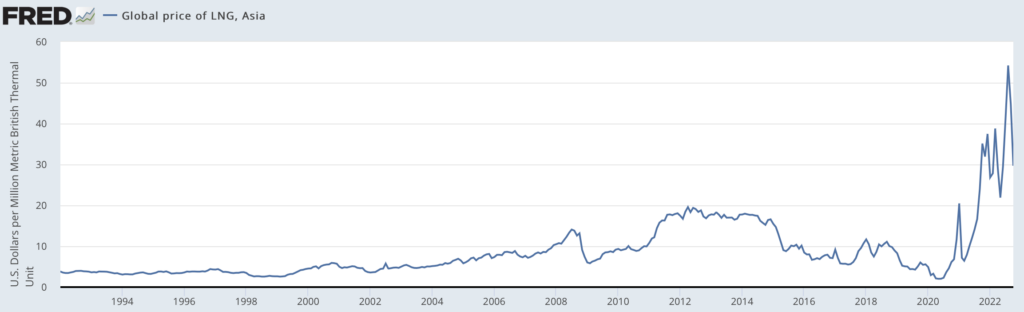

The shares of liquefied natural gas (LNG) companies, including producers and owners of vessels which transport the commodity, were strong performers in 2022. The Russia-Ukraine war forced much of Europe to buy LNG to replace the natural gas that Russia refused to supply as payback for sanctions European countries imposed on it. In turn, global LNG prices exploded higher in 2022, even factoring in some moderation over the last few months. European LNG prices trade in the vicinity of US$33 per thousand cubic feet (Mcf).

Through a combination of conservation, increased LNG imports from the U.S., and mild late fall weather, Europe avoided an energy crisis in 2022. Gas storage levels reached a remarkable 94% of capacity in early December though they have since fallen to about 84% after a cold early-winter period. Still, gas storage is well above the ~63% level in December 2021.

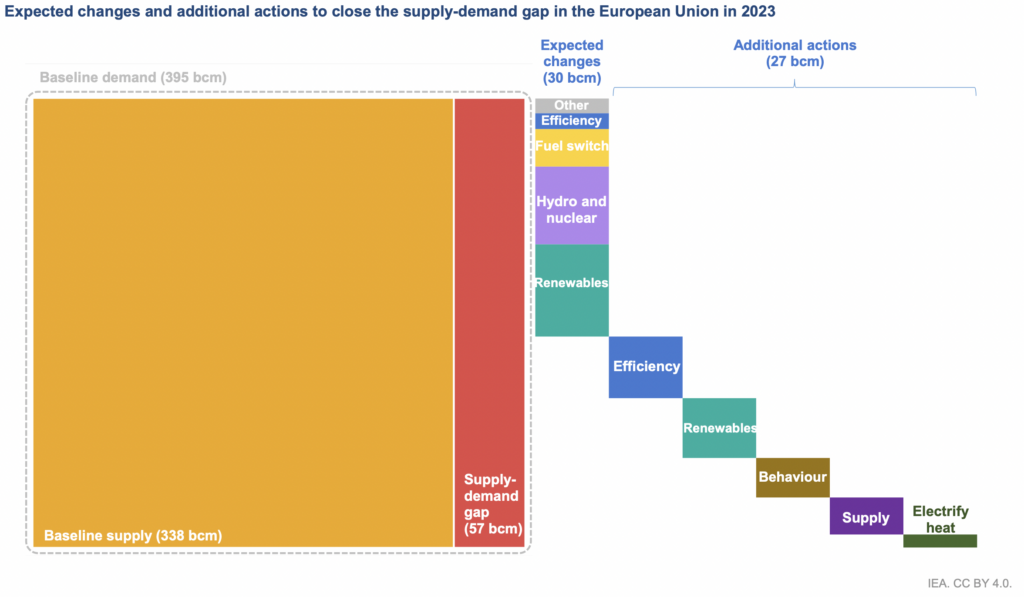

However, an analysis conducted by the International Energy Agency (IEA) concludes that Europe may face a greater energy challenge next year based on two negative assumptions. First, the IEA theorizes that Russia eliminates all deliveries of natural gas to Europe in 2023. Surprising to many (including us), Russia delivered about 60 billion cubic meters (bcm) of gas to Europe in 2022.

Second, China imported much less LNG in 2022 than it has historically due primarily to a weak economy. Wood Mackenzie estimates that China imported about 95 bcm of LNG in 2022, down 14% from 2021.

Under these assumptions, the IEA calculates that the EU’s 2023 gas demand of 395 bcm will exceed supply of 368 bcm (338 bcm of existing supply plus 30 bcm of assumed supply actions already in motion) by 27 bcm. Phrased differently, since the EU consumes on average a little over 1 bcm/day, nearly a month of 2023 gas demand may not be covered.

Separately, in a thinly veiled threat, Qatar, the world’s largest supplier of LNG, warned the EU on December 17 that any investigation by EU authorities into allegations that the Middle East country bribed EU officials could adversely affect energy talks. Qatar currently supplies about 5% of Europe’s natural gas through LNG exports, and it expects two major LNG producing projects to be completed in 2026 and 2027. In late November 2022, Germany signed contracts with Iraq to purchase about 2.75 bcm of LNG per year for 15 years.

Given the potential sizable gap in energy supply/demand, as well as some degree of uncertainty surrounding Qatari supply, it is difficult to imagine that LNG-related stocks will not remain highly sought-after in 2023.

Information for this briefing was found via the links provided and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.