On February 22, Lucid Group, Inc. (NASDAQ: LCID) announced the recall of precisely 203 of the US$169,000 Lucid Air Dream Editions it has delivered to customers. According to a National Highway Traffic Safety Administration (NHTSA) announcement, the company is recalling the vehicles because a front strut damper may fail, which in turn could damage a front brake line and cause a loss of vehicle control.

A strut damper reduces the oscillations of springs in a car’s suspension. Lucid has estimated that only about 1% of these 203 vehicles may actually face failure; no failure has been reported so far.

Lucid’s announcement seems to have two key implications, neither especially positive. First, a start-up car manufacturer which has produced very few cars in its history, yet which the stock market is currently valuing at US$40 billion, must operate almost flawlessly in order to retain investor confidence. Such confidence would allow it to maintain (and possibly grow) that valuation. Customers who bought the first of the cars produced already facing recalls has to strain investors’ degree of assurance.

Second and more tangibly, a recall of 203 vehicles is an extraordinarily precise number. The company told the NHTSA that 188 of the vehicles were manufactured at its Arizona facility over the period October 22, 2021 through January 9, 2022. Dream Air Editions made after January 9, 2022 are unaffected.

The issue with the 188 total is that Lucid had pledged to produce 520 vehicles in 2021 (primarily in 4Q 2021), and the Dream Air Edition is the only model it has produced so far. Phrased differently, Lucid’s 203 vehicle recall announcement implies it could miss its 2021 delivery guidance by a wide margin.

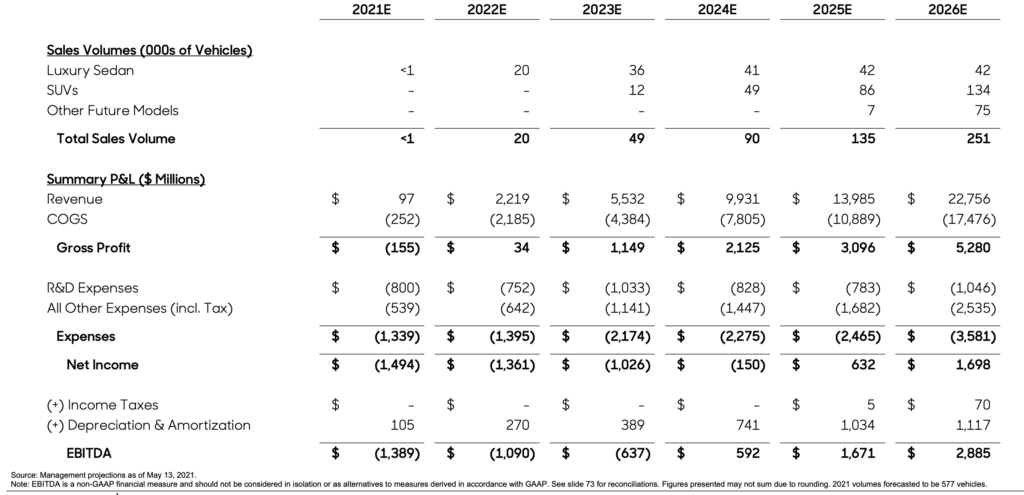

By itself, a 4Q 2021 delivery miss might not impact investor attitudes dramatically because Lucid investors, almost by definition, have a long-term focus. However, the lower 4Q 2021 deliveries could dent confidence in the company’s forecast of 20,000 vehicle sales in 2022. Lucid introduced this projection in February 2021 in presentations related to its SPAC merger process and reiterated it again in a July 2021 investor slide deck. Interestingly, the company did not mention any 2022 production forecast in its 3Q 2021 earnings investor presentation.

Lucid is expected to address 2022 (and possibly beyond) production estimates when it reports its 4Q 2021 earnings after the close on February 28. Any notable reduction in 2022 unit production goals may be poorly received by investors.

As an aside, the cost to Lucid for its recall should be quite modest. An internet search shows the cost of a typical strut assembly replacement may run around US$900 on a retail basis. So, the total cost to the company may be in the US$100,000 range. As of September 30, 2021, Lucid had US$4.8 billion of cash.

Lucid Group, Inc. last traded at US$26.35 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.