Lundin Gold Inc. (TSX: LUG) last week announced it’s third-quarter production results. The company said it produced 121,635 ounces of gold for the quarter at a 90.3% recovery rate, above the 107,663 ounces and 88.8% the company reported last year. Out of the 121,635 ounces, Concentrate produced 81,607 ounces of gold, while Doré produced 40,028 ounces, both materially higher than last year.

Additionally, the company said it processed 379,258 ounces of gold or 4,122 tonnes per day in throughput, with the average head grade being 11 grams per tonne. The company sold 134,640 ounces of gold, above last year’s 111,605 ounces.

Lundin Gold currently has nine analysts covering the stock with an average 12-month price target of C$13.53, or an upside of 33%. Out of the nine analysts, seven have buy ratings, and the other two analysts have hold ratings. The street-high price target sits at C$15.50 from two analysts and represents an upside of 52%.

In BMO Capital Markets’ note on the production results, they reiterate their outperform rating and C$14 long-term price target. They say that the company beat their expectations primarily due to higher grades.

On the results, BMO was forecasting 109,500 ounces of gold to be produced at an average grade of 10 grams per tonne with a recovery rate of 89%. Lundin Mining beat all of BMO’s estimates, though ore processed was 4,122 tonnes per day, missing their estimate of 4,350 tonnes.

BMO adds that Lundin continues to be on track to beat 2022 guidance as the company has produced 355,200 ounces during the first nine months, which means that Lundin only needs to produce 104,800 ounces during the fourth quarter to hit their revised guidance of 460,000 ounces.

Lastly, BMO notes that, although it was expected, gold sales came in higher than production again this quarter. They say that this is from the blockades that occurred in Ecuador at the end of the second quarter which ultimately deferred shipments.

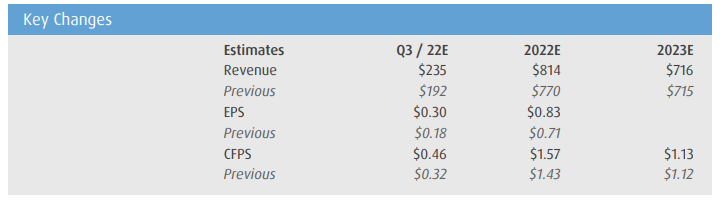

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.