Yesterday Lundin Mining (TSX: LUN) reported their third quarter earnings. Third-quarter cash flows were +$272.2 million, adjusted cash flows were $262 million, attributable net earnings were $122.4 million, and adjusted earnings were $106.4 million. Finally, adjusted EBITDA2 was $300.3 million for the quarter.

In a note, this morning, BMO’s mining analyst Jackie Przybylowski reiterated her C$12.50 price target and Outperform rating. She headlines, “First Blush – Turning the Corner.”

Przybylowski says that the earnings were in line with their expectations. Adjusted EPS came in at U$0.14; the street’s estimate was U$0.14, while her estimate was U$0.13. However, Przybylowski said that they are adjusting their full-year 2002 guidance, which includes lowering their production guidance at Chapada and Neves-Corvo but improving C1 cost guidance at Chapada and Eagle.

She says, “We were pleased to see not only earnings results that were in line with market expectations, but also positive commentary on recovery to the operations which have been challenged,” and believes that the market will look forward to focusing on the opportunities.

Przybylowski says that Lundin is moving away from the recent challenges that plagued the company, such as delays, a fatality at Neves-Corvo, electrical failure and damage at Chapada, and strikes Candelaria. Lundin is now moving towards opportunities as the company is ready to restart its ZEP construction project early next year. She believes that ZEP will be completed early next year and says, “Lundin has also made great progress at Chapada—currently milling at ~30% of capacity and should reach the full run-rate by late Q4/20.”

Przybylowski lists off a bunch of things she will be listening for management to hit on the call. First, is the comments on the Candelaria strike negotiations and how progress is going. The rest include:

- An update on the Chapada expansion. While previously indicated that an expansion plan would be complete by November, the company was plagued by delayed drilling and slower operations due to COVID-19. The result is that this expansion plan is likely delayed as well.

- Lundin currently has its net debt down to $65 million, making it positioned for capital returns in the form of dividends or buybacks. The current buyback program expires December 8.

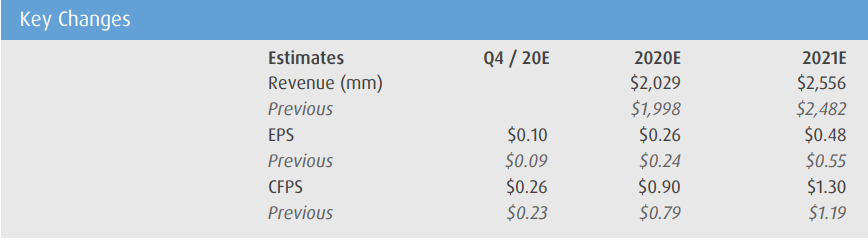

Below you can see the changes in Przybylowski forecasts.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.