Last week, Magna International (TSX: MG) reported its third quarter financial results. The company reported $7.92 billion in revenue, down both year over year and quarter over quarter. The company says this is primarily due to a lighter vehicle production due to the widely known chip shortage, increased production and commodity costs, and “unpredictable OEM production schedules.”

The company reported gross profits of $1.03 billion, or a 13.1% profit margin along with an operating profit of $27 million or a 0.03% operating margin. Net income for the quarter was $11 million for earnings per share of $0.04 and pro-forma EPS of $0.56.

A number of analysts lowered their 12-month price targets on Magna International after the results, bringing the average to US$103.15, down from US$103.15 before the results. The company currently has 10 analysts covering the stock, with 1 analyst having a strong buy rating, 8 have buy ratings and 1 analyst has a hold rating on the stock. The street high sits at US$126.65 while the lowest 12-month price target comes in at US$84.

In BMO Capital Markets’ third quarter review, they reiterate their outperform rating and $97 price target saying that the results came in line with their expectations and anticipate the company’s semiconductor issue to be resolved by the second half of 2022.

For the quarter, BMO says that Magna came in above their US$0.52 adjusted earnings per share estimate but gives no extra clarity on their expectations going into the quarter. They do say that they believe management’s idea that this quarter was likely the trough and BMO expects tailwinds to help drive strong production. BMO notes that Magna took a US$45 million provision on engineering services related to Evergrande’s car unit.

BMO comments that the company purchased roughly 2.9 million shares year to date and has the ability to purchase up to 29.9 common shares – about 10% of its float. BMO writes, “We believe the modest purchases under the current bid are due to black-outs related to the pursuit of Veoneer and hesitancy given the negative impact on cash flow from the semiconductor shortage.”

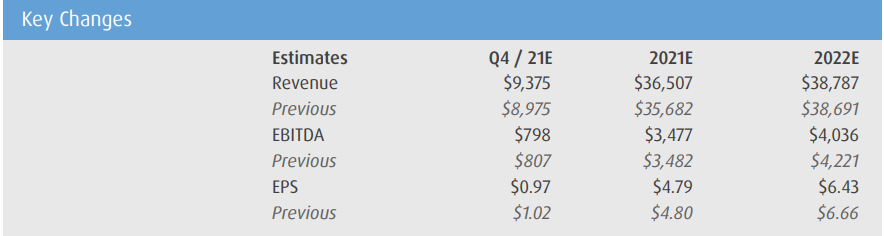

Below you can see BMO’s updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.