On August 16 BMO Capital Markets slightly lowered their 12-month price target on Magna International (TSX: MG) while reiterating their outperform rating. They say the reason for the price target change is due to revising their third quarter earnings per share estimate to $1.47 from $1.63.

Magna International has 10 analysts covering the stock, with 1 having a strong buy rating, 8 have buy ratings and 1 analyst has a hold rating. The consensus 12-month price target sits at $111 while the street high comes in at $129.45 and the lowest is $88.

With the chip shortage still heavily in effect, BMO has lowered its expectations around production. They say that the West Detroit Three production is now expected to increase 31% sequentially, lower than their original 50% estimate. The companies revenue meanwhile is expected to grow 14%, underperforming its production increase.

The company’s western production is expected to decrease 4.5% sequentially, which is 1% weaker than their original estimate. Revenues from Magna’s European platforms are estimated to decrease 5.5% sequentially. This is primarily due to the companies top platforms, the BMW 1-Series and Volkswagen Tiguan, both expected to drop 22% sequentially.

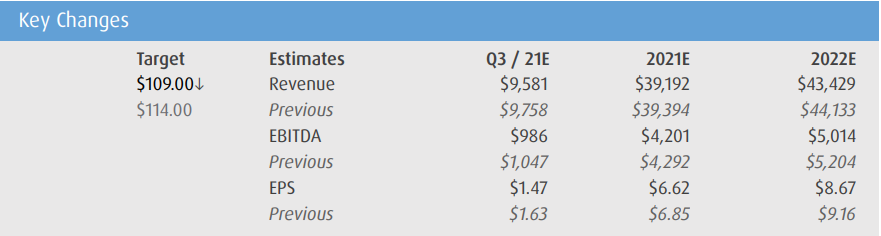

Below you can see BMO’s updated third quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.