Magna Mining (TSXV: NICU) is one of the biggest losers on the market over the course of the last week, falling as far as 11% in early morning trading, after declining 10.6% yesterday, and as much as 32% since closing at $1.42 last Wednesday.

Highs of $1.49 were achieved by the company last Wednesday, after Magna put out a series of positive assay results from its Crean Hill Mine, which is located near Sudbury, Ontario. The company has managed to intersect high grade nickel mineralization within the past producing mine, which was previously operated by Inco and Vale for over eight decades.

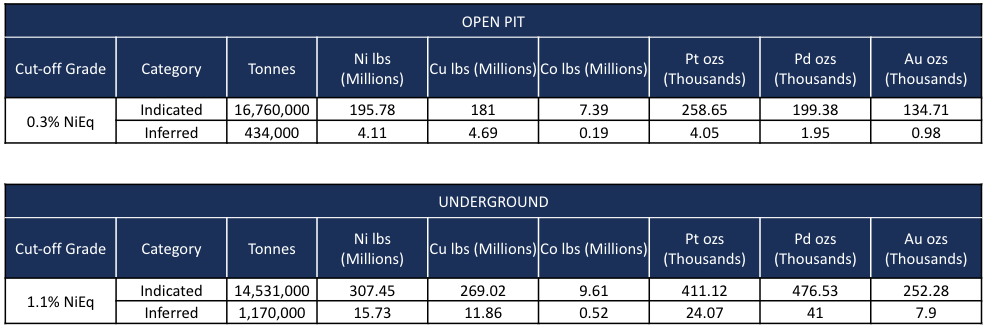

Positive sentiment on the name began back in November, when the firm closed on its purchase of Lonmin Canada for $16.0 million, which brought the Crean Mine and the Denison Project under Magna’s ownership. A resource estimate released on the day of closing the transaction indicated the Crean Mine has a current resource estimate of 500.0 million pounds of nickel, 450.0 million pounds of copper, and 1.7 million ounces of platinum+palladium+gold within the indicated category, via underground and open pit mining models.

The positive sentiment however really began to take off on January 5, when the company posted its second round of assay results from recent drilling at Crean Hill, which saw the firm intersect 4.0% nickel, 0.7% copper, 0.36 g/t platinum and 0.25 g/t palladium over 31.06 metres.

READ: Magna Mining Hits 31 Metres Of 4.0% Nickel At Crean Hill

Four days later, the company continued the positive results, releasing assays of 0.39% nickel, 0.49% copper, 3.36 g/t platinum, 2.28 g/t palladium and 1.59 g/t gold over 98.26 metres, with the intersect beginning at a depth of 26.55 metres.

The recent share decline however is largely believed to be the result of an oncoming share unlock. The aforementioned purchase of Lonmin Canada was financed via a $20.0 million non-brokered private placement, which was conducted at $0.27. The financing saw units priced at $0.27 sold, with each unit containing one common share and one half warrant. Warrants are valid for a period of three years from the date of issuance, and contain an exercise price of $0.405.

With the financing closing on September 30, the 74.1 million units sold under the offering are set to come free trading at the end of this month. And with the equity rising as high as $1.49 – a 5.5x on the unit price of the offering – current selling pressure is believed to be related to that transaction.

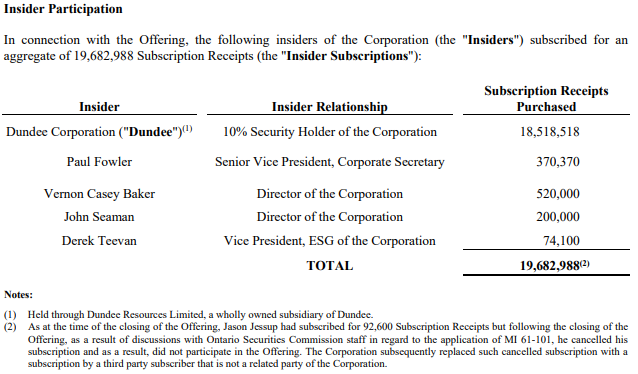

To be fair to Magna, 19.7 million of those units, or 26.6%, were sold to insiders of the company.

An additional 18.5 million were sold to Hawke’s Point Holdings II, whom became an insider as a result of the transaction, bringing total insider participation in the financing to 51.5%. This in turn leaves 35.9 million units that could hit the market in the coming weeks.

While it cannot be expected that all those shares will be sold, one must consider the current average trading volume of the equity. Presently, the 30 day average volume sits at 674,084 shares being traded per day. Should only 10% of those non-insider units elect to be sold off – roughly 3.6 million – this figure still represents 5.32 days of trading.

While the share unlock serves as an overhang for current investors, potential positives remain for the company. A current diamond drilling program consisting of 15,000 metres was set to begin on January 9, while assays from eight drill holes remain outstanding from the 2022 fall program.

Magna Mining last traded at $1.04 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.