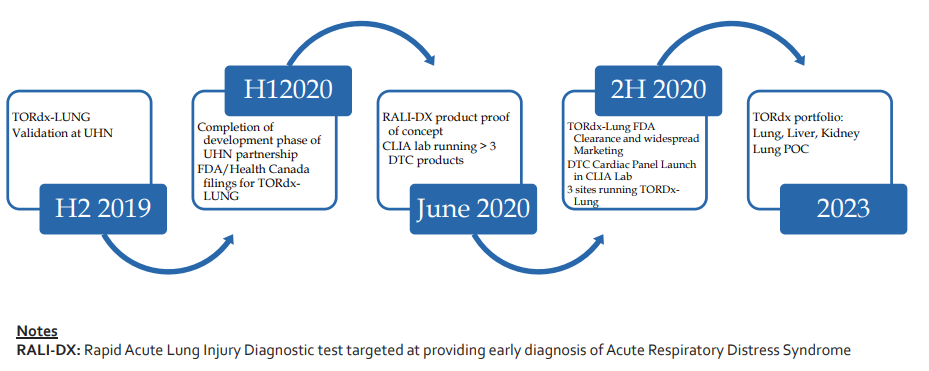

This morning Toronto based SQI Diagnostics Inc. (TSX-V: SQD; OTCQX: SQIDF), announced they have been selected by the University Health Network (UHN) to receive funding for the validation and testing of their novel assay, known as Rapid Acute Lung Injury Diagnostic, RALI-Dx. Under the research, they will utilize this previously developed SQI assay to assist clinicians in the triaging of patients with COVID-19. Recently the UHN received a $1 million grant awarded by the Canadian Institutes of Health Research, which the UHN has earmarked a portion to SQI Diagnostics to validate RALI-Dx .

SQI Diagnostics isn’t just a ‘Coronoavirus pop up.’ The cash infusion from the UHN demonstrates the company is chasing a real practical solution to help hospitals fight COVID-19. The company has been developing and commercializing proprietary technologies and products for advanced microarray diagnostics for years prior to this grant. Their proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide high quality data.

Joining the global fight against COVID-19 presents a tremendous opportunity for SQI… Not only is it an opportunity to allow our organization to commercialize an assay we have already developed, but it is also an opportunity to make a positive impact for people around the world.”

Eric Brouwer, PhD, interim CEO of SQI

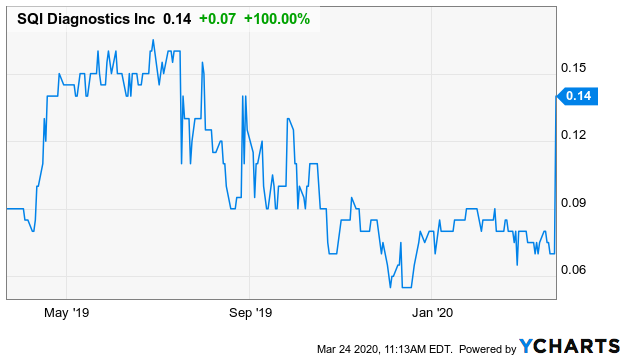

Since announcing the news the stock doubled:

SQI sees an opportunity to help hospitals with scarcity of critical resources such as ICU beds and ventilator machines by providing the ability to objectively identify who requires admission to intensive care. Hospitals are already facing significant pressure in triaging patients in respiratory distress. RALI-Dx is ideally positioned to fill this need and serve as a tool to manage limited critical resources in this historic time of need.

At the time of publishing, SQI’s share price has risen over 107.1% to 14.5c.

Information for this briefing was found via Sedar and SQI Diagnostics. The author is currently long SQI Diagnostic common shares and may sell them at anytime. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.