Medipharm Labs (TSX: LABS) announced third quarter earnings this morning, posting revenues of $43.38 million for the three month period ended September 30. The firm had a gross profit of $14.75 million, which resulted in a net income of $3.27 million for the period.

Medipharm revealed significant growth on a quarter over quarter basis, with revenues increasing 37.85% from second quarter revenues of $31.47 million. Expenses increased marginally, from $3.22 million to $3.57 million. Marketing and selling expenses trended down from $0.85 million to $0.73 million. The big ticket increase during the quarter was share based compensation expense, which increased from $2.74 million to $4.15 million.

Despite posting a net income for the third quarter, operating expenses resulted in a cash flow negative operation. Operational expenditures during the quarter amounted to $20.12 million, a significant increase from the prior period. Capital expenditures during the quarter amounted to $10.79 million, resulting in Medipharm’s cash position decreasing from $72.72 million to $42.11 million.

Trade receivables increased during the quarter, from $25.36 million to $40.78 million. Inventories also continued to climb, from $42.42 million to $54.08 million. Total current assets decreased marginally, from $142.92 million to $140.85 million.

In terms of current liabilities, figures were relatively unchanged on a quarter over quarter basis. Trade payables decreased from $43.67 million to $41.70 million. This decrease was offset by an increase in tax liability, which climbed to $4.41 million from $2.38 million. Current liabilities increased marginally overall, from $53.20 million to $53.56 million.

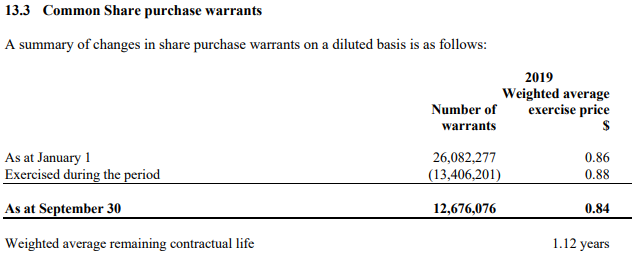

Looking down the financial statements, several other items stand out. In particular, Medipharm currently has a number of stock options and common share purchase warrants that are deep in the money. In the case of warrants, 12,676,076 remain outstanding with an average exercise price of $0.84. The weighted average remaining contractual life on these warrants is 1.12 years, meaning that selling pressure is likely to hit the equity over the coming months. In terms of options, 11,441,280 remain outstanding with an average exercise price of $2.72 and an average life of 4.20 years.

Furthermore, there is some risk to Medipharm’s operations in that 91% of its revenues during the quarter came from 5 clients that represented more than 10% of revenues each. During the 9 month period, 4 clients represented more than 10% of total revenues each for Medipharm.

Medipharm Labs closed yesterdays session at $5.05 on the TSX.

Information for this briefing was found via Sedar and Medipharm Labs.. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.