On September 23, Medmen Enterprises (CSE: MMEN) reported their fiscal fourth quarter financial results. The company reported revenue of $42 million, up 18.5% quarter over quarter and 55.4% year over year. The company saw gross margins come in at 46.9%, up from 40.5% last quarter.

On October 5th, Cantor Fitzgerald reiterated their $0.28 12-month price target and Neutral rating after a call with management. They say that the although comps for this quarter were depressed, their sales in California, Nevada, and Arizona which grew at rates of 24%, 44%, and 17% respectively, were noteworthy.

They write, “Sales and EBITDA trends continue to improve as the company’s turnaround gains traction.” Medmen is aiming to operate premier retail cannabis stores and provide customers with higher than normal experiences in their stores. Cantor says that the data shows that the results getting towards this experience is mixed with “revenue per store below the respective state averages in AZ, FL, and NV (about half the state avg in FL/NV), only inline in IL, and about 25% above in CA.”

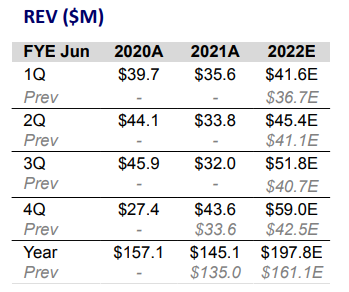

Below you can see Cantor’s updated estimates for Medmen.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.