After the bell, Medmen Enterprises (CSE: MMEN) released their 4th quarter earnings. The headline for the quarter in our opinion is the combined annual cash burn of $316.87M (combined operating and investing cash flows).

When I breakdown quarterly numbers, I like to look at some of the key data on a quarter over quarter basis:

| Q4 | Q3 | % change | |

| Revenue | 42.0 | 36.6 | 14.7% |

| Gross Margin | 16.0 | 15.5 | 3.1% |

| Gross Marin % | 38.1% | 42.4% | |

| System Wide Revenue | 42.0 | 36.6 | 14.8% |

| G&A Expense | 51.3 | 61.3 | -16.2% |

| Sales and Marketing Expense | 7.4 | 6.7 | 10.6% |

| Net Loss | -82.9 | -63.1 | 31.5% |

| Operating Cash Flow | -51.9 | -59.2 | -12.4% |

| Investing Cash Flow | -41.1 | 27.5 | |

| Adjusted EBITDA | -39.4 | -42.6 | -7.4% |

From The Conference Call

- There remains $125M of cash on the facility from Gotham Green, which they are planning to restructure to current market conditions.

- Targeting 30 stores in California by the end of next fiscal year.

- The companies long run goal is 60% retail gross margins.

- Majority of cash burn moving forward is on the operating side, ie. ramping stores, not on building facilities.

- Main focus is on California, Florida and New York.

- Company is targeting a full 30% reduction in SG&A.

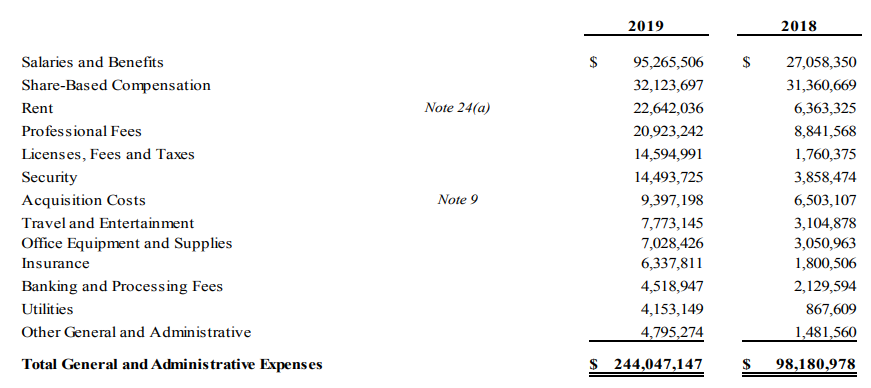

Breakdown of Expenses

From the notes, we can see some of the significant line items on SG&A. Where it is interesting to note the nearly $8M spent on travel and entertainment.

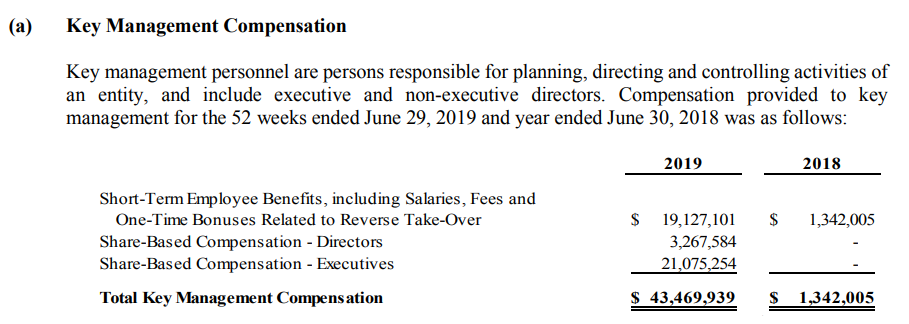

Also of note, the company’s executives received around $21M in share-based compensation, which is likely comprised of way out of the money options that will never be exercised.

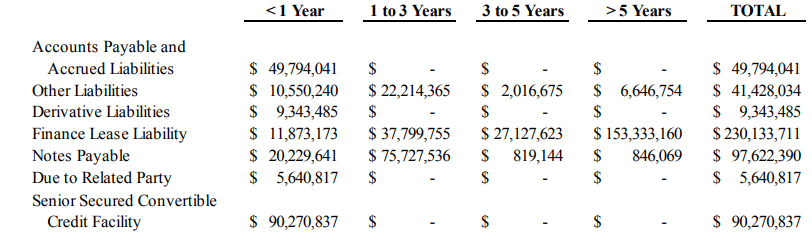

On the cash concerns. The company has nearly $90M in convertibles (which are way out of the money), plus another $70M in accounts and notes payable all due in less than one year.

Overall Thoughts On The Quarter

Medmen remains one of the most interesting companies in the cannabis public markets. The company has invested more money into building out brands than anyone else in the space. They are the market leader, in a highly fragmented state that often sets the tone for brands across the US.

Overall, the company only grew topline revenue by 15% quarter over quarter and continues to burn cash at an alarming rate. Investors will want to keep a keen eye on the companies ability to raise cash over the next few quarters. Medmen tells us they had gross margins of 50% vs. 53% last quarter for retail, which we cannot assess because this a non-IFRS number and the gross margins reflected on the income statement is actually sub 40%. At the time of the conference call, the company still had yet to publish the full statements on sedar.

Information for this briefing was found via Sedar and MedMen. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Canopy’s Quarter in Charts

Whenever there’s a negative margin, those of us in the financial content biz like to...