On October 26th, Meta Platforms Inc (Nasdaq: META) reported its third-quarter financial results. The company continued the trend of tech companies disappointing investors as the company reported revenues of $27.7 billion, down 4%. At the same time, costs and expenses were up 19% to $22 billion. This dropped the companies operating income to $5.66 billion, down 46% or an operating margin of 20% compared to 36% a year ago.

Net income decreased by 52%, going from $9.2 billion to $4.4 billion, or earnings per share of $1.64. The company reported capital expenditures of $9.52 billion for the third quarter as it continued to invest in its virtual reality initiatives. Additionally, the company repurchased $6.55 billion in shares during the quarter and had $41.78 billion in cash at the end of the quarter.

The company said daily active users grew 3% to 1.98 billion, while monthly active users grew 2% to 2.96 billion. While ad impressions increased by 17%, and the average price per ad decreased by 18% yearly.

The company provided fourth-quarter guidance. They expect revenues to come in between $30 and $32.5 billion while saying that they have increased their scrutiny “on all areas of operating expenses” but note that the company is in “a substantial investment cycle, so they will take time to play out.”

As a result, the company increased its 2023 total operating expenses to $96 and $101 billion, up from $85 to $87 billion. Specifically, the company expects operating losses from their Reality Labs unit to grow in 2023 but will “pace” investments into the unit after 2023.

After the results, several analysts lowered their 12-month price target on Meta, bringing the average long-term price target down to $156.91 from $224.29 a month ago. Out of the 58 analysts, 14 continue to have a strong buy rating on the stock, 21 have buy ratings, 19 analysts have hold ratings, three analysts have sell ratings, and one analyst has a strong sell rating on the stock. The street-high price target is $392, representing an upside of 300%.

Canaccord Genuity Capital Markets’ reiterated their buy rating following the results. Still, they slashed their 12-month price target to US$200 from US$250, saying that a strong USD and the challenging macro backdrop is “expected to drive a further top-line contraction.”

With Meta shares hitting a six-year low, Canaccord believes that investors should look at the improvement of Reels monetization and the lapping of Apple’s privacy change to provide investors with a favourable risk versus reward for long-term investors.

Meta’s ad revenue came in at $27.2 billion, slightly above Canaccord’s estimate. They note that headwinds relating to Apple’s privacy change are starting to ease with the lapping of the results. They note that this headwind is just being replaced with the macro uncertainty and how it will impact advertiser budgets.

The analysts say that Reals continue to drive increased engagement as aggregate time spent on both Facebook and Instagram increased yearly in the US and globally. Meta noted that there was roughly a $500 million headwind to advertising revenue due to the shift of engagement to short-form video, as Reels have a much lower monetization rate.

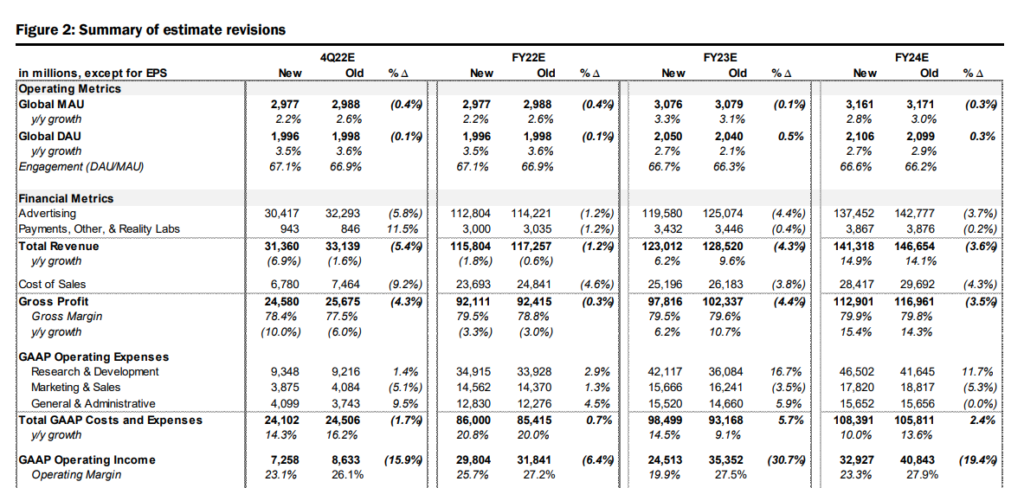

Below you can see Canaccord’s updated estimates. They note that the many revisions come as the company will continue to see headwinds to advertising revenue and the broader macro environment.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.