This past week, Metalla Royalty & Streaming (TSXV: MTA) announced that they have acquired a 1.35% net smelter return royalty on the Côté Gold Project and all of the Gosselin project. These two projects are owned by IAMGOLD and Sumitomo Metals Mining. This comes at a total purchase price of $7.5 million in cash, which was originally funded by their at-the-market financing.

On the back of this news, two analysts raised their 12-month price target, bringing the consensus estimate up to C$14.35, or a 15% upside. The company currently only has five analysts covering the stock, with two of them having buy ratings and the other three having hold ratings. The street high sits at C$15 while the lowest is C$13.75.

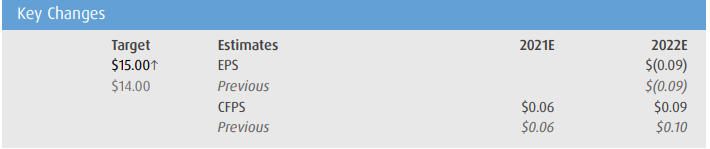

In BMO’s note yesterday, they raised their 12-month price target to C$15, up from C$14, and reiterated their market perform rating says that these transactions are accretive to their NAV estimates.

Their analyst believes that this deal highlights the future potential of the Gosselin project, which is expected to ramp up to commercial production in the second half of 2023 and return an estimated 493k ounce of gold in the first five years of operations.

BMO looks back to IAMGOLD’s fourth-quarter earnings call and says that the CEO provided good insights into the potential of this mine. The CEO said that mine has been designed with a future expansion of ~20% in mind and that there are 6-7 years of “relatively high grade before getting into a lower-grade valley.”

Below you can see the slight 2022 estimate adjustments made by BMO.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.